Life Science Tools and Services - Sector Analysis

One of the most resilient sectors in the market... Great hunting ground for compounders. Quick overview

Investors that have been in the markets for long enough end up finding out that there is a strange group of science-related companies that nobody really understands. These companies have been delivering above market returns for decades. Most find out about this sector through Thermo Fisher Scientific and Danaher Corporation which are the two largest and most notable companies.

The reason why most investors do not understand these companies is because they do not have a science background, however, you need to know that most scientists do not fully understand these companies either since scientists are usually specialized in one of the many different science technical fields and are not business people or active investors that have knowledge about the whole sector. These companies are outside the natural circle of competence of most investors (and scientists!).

It is also hard for me, as a retail investor who works in the industry and has a degree in Chemistry to explain and understand this sector. The industry is so large and has so many sub-sectors that it is hard to understand it all. However, I will make an attempt to do it. Additionally, I will say that it is worth to put some long hours on trying to understand this industry since it’s companies have some unique characteristics.

Hope you can appreciate it, and make sure to subscribe to my substack for further updates!

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument. Please do your own research. My analysis could be totally wrong and the stock could have negative returns. This information is for general purposes only and should not be considered as investment advice. I am not a financial advisor and do not offer investment recommendations.

DISCLOSURE: I currently own shares of Eurofins Scientific. I do not own shares of any of the other stocks mentioned, but I might in the future.

What is Life Science? And why tools and services?

Life Science complies the branches of science that involve the scientific study of life (micoorganisms, plants, animals,… and most importantly humans!). Biology is the generic science that studies life, and then there is a list of many more concrete specialties such as: Biochemistry, Biotechnolgy, Microbiology, Pharmacology,…

Life Science Tools and Services companies provide instruments, consumables and services to many type of scientific customers such as Pharmaceutical, Laboratories, Universities, Hospitals,… They provide the essential consumables, reagents, instruments and services that these customers need.

The consumables are usually packed in boxes of many units and are products such as single-use containers that must be constantly bought since customers have a recurrent use.

Chemical reagents are also consumables, they usually come in a plastic or glass bottle that contains 1L - 2.5L if it is a liquid or 500g - 1 kg if it is a solid and also need to be bought constantly.

The instruments are the non-recurring sales. There are very expensive machines that can cost hundreds of thousands or even millions of dollars that only need to be bought once and can last for many years (there are maintenance contracts though). There are also cheaper instruments that cost hundreds of dollars. Instruments use consumables and reagents.

The services are performed from a company to another, such as analysis and testing, or even the maintenance contracts of the instruments.

This is a very simple overview but I hope you understand how it works a bit better now.

Science is a risky business with a high failure rate but a giant price for winners who discover new drugs. The sector is characterized by constant innovation. The Science sector is a lot like venture-capital because experiments are very expensive and only some of them end up reaching commercial stage and getting a huge return on investment.

The companies in Life Science Tools and Services provide the basic instruments, consumables and services needed in science, so they do not assume these risks. We could say that they are the “picks and shovels” play of global science.

If you are a long-term investor, I would say Life Science Tools and Services companies are a great place to be. There are many features that make this sector special. Some of them include:

Growth Potential: Driven by factors such as an aging population, increased healthcare spending, and growing demand for new treatments.

Strong Regulatory Framework: The industry is highly regulated, with stringent testing and approval processes that help ensure the safety and efficacy of products before they are brought to market. This regulatory framework provides some level of protection for investors. A barrier to entry for competitors.

Recession resistant: The life science sector tends to be recession-resistant, as people will continue to need healthcare regardless of economic conditions.

Government Sponsored and Protected: These companies are often focused on developing treatments and technologies that can improve human life. For this reason, Governments work together and are customers of these businesses.

Recurring demand: Many of their products are consumables and services that need to be bought constantly.

Durability: Maybe the most important one. These are businesses that have been surviving and growing for decades, even over a century in some cases! Terminal value is among the highest in the markets.

Is the Covid Hangover an Opportunity?

Covid-19 was a huge event that benefited most of the sector. Some companies had more exposure than others but all of them tried everything they could to get some of that high-margin, mostly government financed revenue to fight against the pandemic.

Any investor who identified that this was an Event-Driven situation that was going to positively impact many companies could have made huge returns since March 2020 (sadly, it was not the case for me since I was not yet educated on Event-Driven Investing).

I was not willing to write about this sector or even invest in this sector for the past two years since the market valued many of these companies at high multiples of covid-inflated earnings and margins thinking that the party was going to last forever. Check for example the chart below of Eurofins Scientific.

I would say the covid hangover might create good opportunities in this sector if some stocks overcorrect. But it also makes it really hard to value this companies.

You can NOT rely on 2020, 2021 or 2022 numbers since they might be inflated by high-margin covid revenues, so make sure to think how will numbers look like in 2024 and beyond. Margins should mean-revert and most of covid-revenue will be lost.

Acquisition strategy and organic growth

Many companies in the industry have a “serial acquirer” strategy. It must be noted that since this are high quality, durable businesses, usually the multiples paid for the acquisitions are pretty high and returns on the capital employed are low. For this reason, it is important that they are able to integrate and improve the acquired businesses, finding synergies and cross-sell opportunities. I would say that the best performers are the ones who, besides a good acquisition integration strategy, had great organic growth.

I would say that none of these companies will deliver outsized returns (such as >25% CAGR) in the long-term. The reason is that usually the capital is employed in buybacks or acquisitions at high valuations. However, the reason you might still want to own some of these companies, is that, although long-term growth in EPS might be 10-15%, there is a very low chance that these companies will not perform for decades due to the nature of the resilient and necessary businesses they operate.

The buyback cannibals

There are some companies that use all free cash flow (or almost all) for buybacks. They have high single digit organic growth, plus margin expansion, plus buybacks of 2-4% of the shares per year. The problem is that they mostly have already expanded their margins a lot and the market has re-rated them to high multiples where the buybacks have lower impact.

List of Life Science Tools and Service Compounders

Here is a list of some Life Science Tools and Service companies I got from my TIKR screener, ordered by market cap. You will also see their return in the past 10 years, net income CAGR in the past 5 years and Forward P/E. I ordered them by market cap, because in theory, the larger you grow, the harder it is to keep growing at a fast rate, but TMO and DHR have been defying gravity for a very long time! There is a lot more companies than these ones, but it is a good start.

Now here you have the same list ordered by net income CAGR in the past 5 years.

Quick comments on some companies

Now I will make some quick comments on some of the stocks in the list.

Note: I have only looked at most superficially, so take this only as a starting point! For many names, I have used analyst estimates, which I do not think is a valid way to analyze companies, but it was just a quick look, so make sure to rerun the numbers (obviously).

Thermo Fisher Scientific

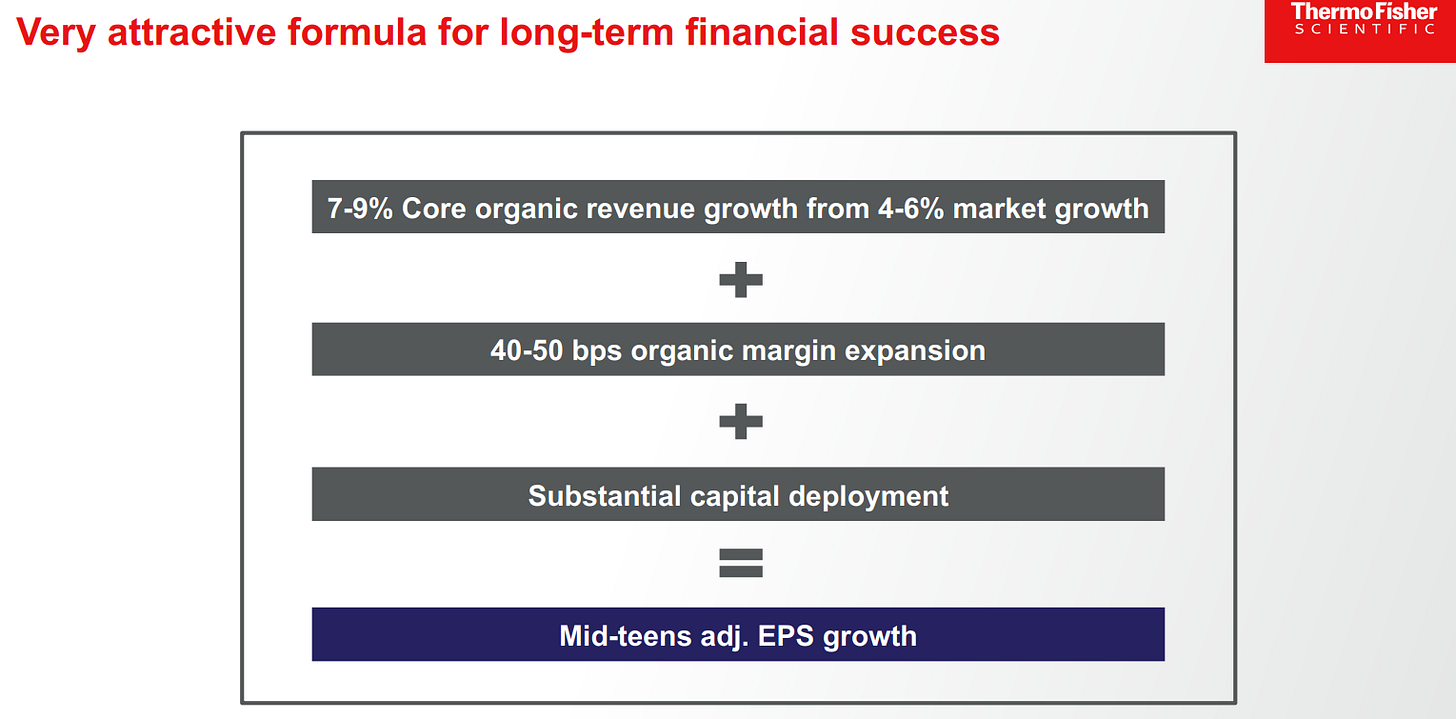

Business: The industry leader. Very diversified and recurring revenue. Big investments in R&D to continuously improve their products. Organic growth should be around or above the market’s growth. I would say ~7-9% CAGR.

Thermo Fisher Scientific operates as a single, integrated company, with a centralized management structure. They have a global presence and a diverse range of product lines and brands. Thermo Fisher Scientific emphasizes operational efficiency, global reach, and leveraging their broad product portfolio to serve their customers.

Capital Allocation: Around 30% of capital is returned to shareholders via buybacks and a small dividend and the rest is used in acquisitions. Acquisitions are also funded with some debt. Long-term, the sum of acquisitions, small buybacks and organic growth should make the EPS grow at 10-15% per year (but not more in my opinion).

P.S: Buybacks and dividends don’t make much sense to me for TMO.

Valuation: A long-term shareholder should be able to get around 10-15% CAGR for decades with this name. Management thinks that they can deliver mid teens EPS growth with the following formula, which also includes some margin expansion. If you believe in the margin expansion, this looks viable, but if not, it should still be around 10-12%.

However, if we want to get a good entry point, we need to look at the current valuation.

Market Cap: 200B as of 11 June 2023

Net Debt: 32B

Company is guiding for 6.9B of FCF for 2023 which means it is trading at an expensive multiple of 33.6x EV/FCF and 29x Price/FCF. There is no explanation on how much working capital the guidance includes.

The company also provides an adjusted EPS guidance of 23.7 which would be a ~22x price to earnings ratio, which seems much better. However we must note that the adjustments in the EPS include acquisition-related costs, restructuring and amortization of intangible assets acquired and GAAP EPS and FCF are lower. Analyst estimates for GAAP EPS for 2023 are at 17.63 which would be a 29x price to earnings ratio.

I think that the company has not yet corrected enough from it’s covid boost. It might not correct but I do not see a lot of margin of safety with this valuation.

Danaher

Business: Also an industry leader. Very diversified and recurring revenue. Big investments in R&D to continuously improve their products. Organic growth should be around or above the market’s growth. I would say ~7-9% CAGR aswell.

Danaher operates as a conglomerate with a decentralized structure (very different to TMO in this aspect). The company is organized into various operating companies, such as Beckman Coulter, Cepheid, Leica Biosystems, and Hach, each of which specializes in a specific industry or market segment. Each operating company operates autonomously to some extent, with its own management team, strategy, and focus.

P.S If you ask me, I prefer the TMO centralized model, having many brands under one big umbrella with a centralized structure. But both are great with their pros and cons.

Note: A segment of the company will be spinned off in Q4 2023.

Capital Allocation: Almost all FCF is used for acquisitions (I prefer this than the TMO dividend and buybacks that don’t add much value in my opinion). They do pay a small dividend though, but no buybacks. For funding they also use some debt and issue small amount of shares.

Spinoffs: Danaher constantly spins off non-performing segments such as Fortive Corporation (industrial, 2016) and Envista Holdings (dental, 2019).

In Q4 2023 they plan to spin off a segment related to water quality controls (Veralto) that had mediocre organic growth and margins.

In general, the spinoffs have not performed well, so a shareholder should probably sell them if they are valued at a normal to high multiple.

Valuation:

Market cap: 173.5B

Net debt: 13.5B

Analysts have GAAP EPS at 7.82 for 2023 which would be a 30x PE ratio. FCF estimate is 7.4B which gives it an EV/FCF of 25 and a Price/FCF of 23. Looks cheaper than TMO on a FCF basis currently.

I think long-term returns should be symilar to TMO. I think a long-term investor in this sector could own both companies with similar weighting. No need to choose.

Mettler Toledo

Business: Mettler-Toledo International Inc. manufactures and supplies precision instruments and services. Since there are practically no covid revenues, it does not have a covid hangover!

Capital allocation: Buyback cannibal. Most FCF is used for share buybacks resulting in a yearly reduction of around 3% of shares. There has been a ton of multiple expansion due to the share buybacks.

Valuation: 14% net income CAGR, 3% share reduction per year, operating margin and multiple expansion explain the outsized gains it has had in the past. But can it continue at this pace? Most likely NO.

PE ratio is already 33 and they also carry 2B of debt, lowering the impact of buybacks, operating margin is already 29%. How far can they take this? I am not sure but I do not find it sustainable. I think the stock will have way lower returns in the future.

Agilent

Business: Agilent’s products include instruments, software, services.

Capital allocation: Most FCF goes to buybacks and dividends with some occasional acquisitions. Same case as MTD but with worse returns since there has not been so much margin expansion.

Valuation: I would say Agilent is fair valued at a 25x forward GAAP PE ratio with a nice balance sheet. There has also been a lot of operating margin expansion like with Mettler Toledo and this explains a huge part of earnings growth. I also think the stock will have lower returns in the future than it had in the past. But probably 10% EPS growth are achievable.

Sartorius Stedim Biotech SA

Business: Provider for the biopharmaceutial industry that helps its customers to develop their production processes and manufacture biotech medications and vaccines more efficiently.

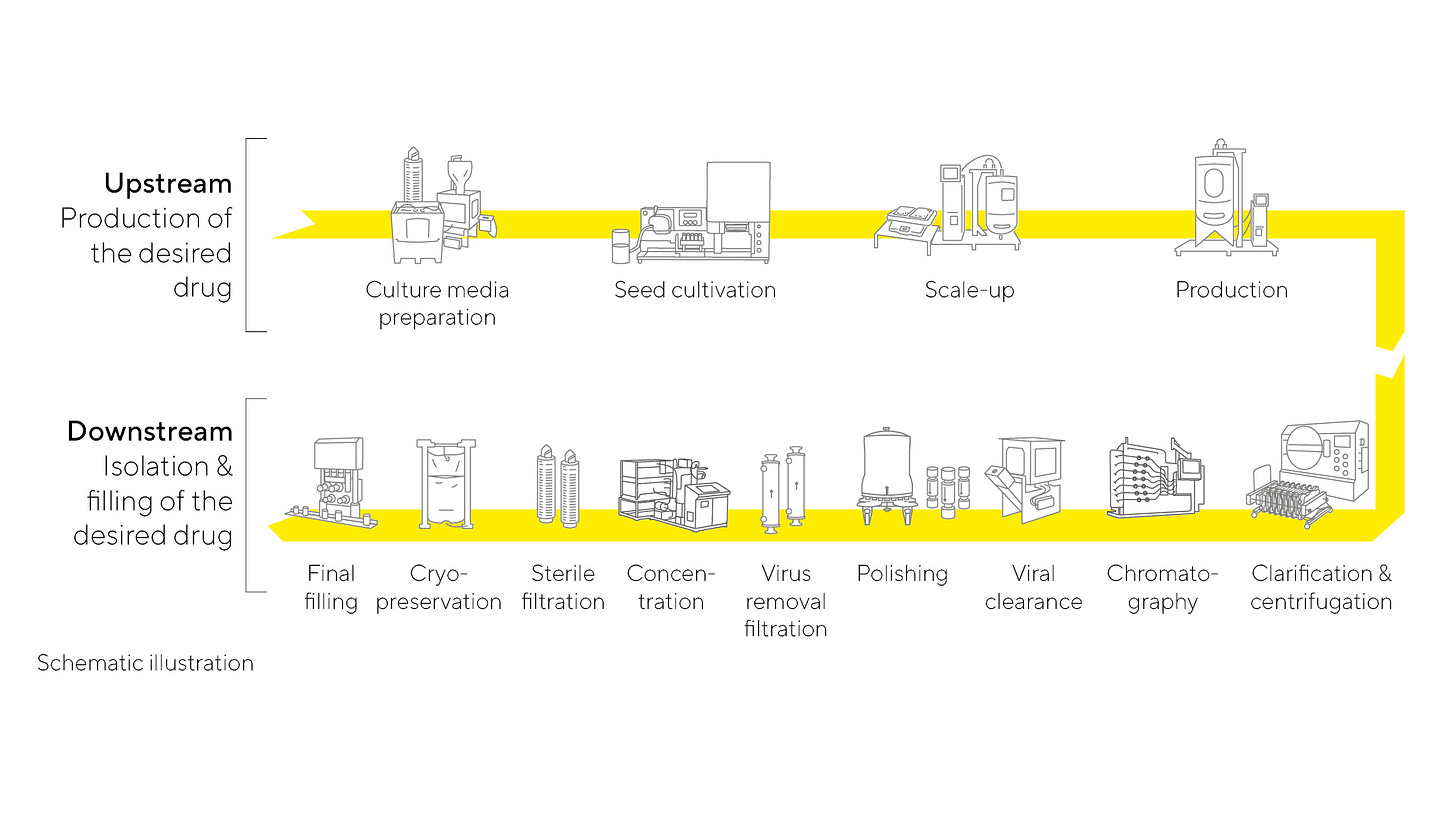

It takes more than ten years on average to bring a new drug out on the market, costing more than two billion euros. On top of this, biotechnological manufacturing processes for such high-tech medications are demanding and must be developed individually for each biologic compound. The business is hard to understand, just take a look at the picture below, but it looks like there surely is an opportunity.

Sartorius Stedim Biotech offers a broad portfolio of products that focuses on all major steps in the manufacture of a biopharmaceutical, as well as in process development as prerequisite procedures. The product range includes cell lines, cell culture media, bioreactors, a wide range of products for the separation, purification, and concentration of biological intermediates and finished products, as well as solutions for their storage and transportation. Sartorius Stedim Biotech also offers data analytics software for modeling and optimizing processes of biopharmaceutical development and production. In its core technologies, the company has leading market positions with high double-digit market shares.

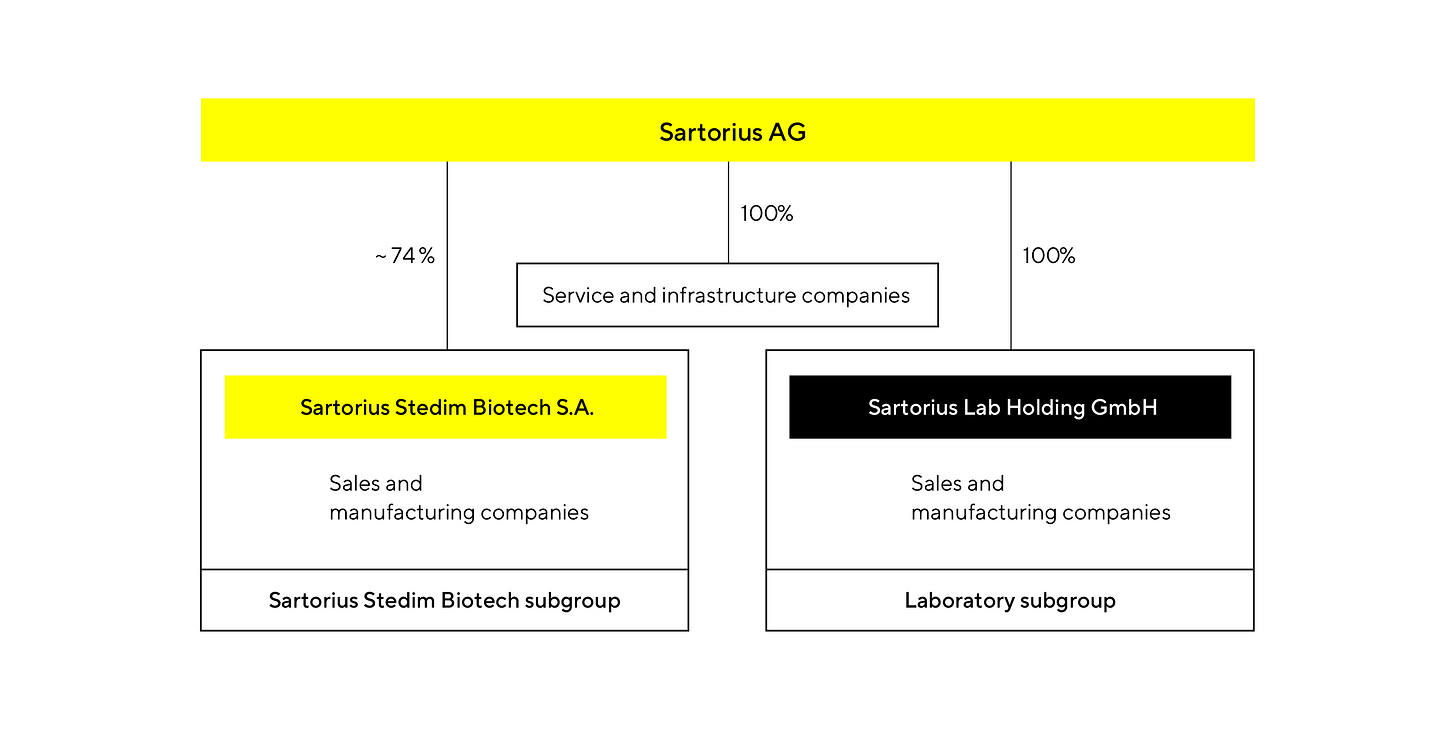

Sartorius AG (also listed) owns 74% of the company in addition to a laboratory product company. It has been a very fast compounder that now is suffering from bad covid comps.

Capital allocation: Mostly targeting organic growth but with some acquisitions and a small dividend. The organic growth track record has been impressive with operating income growing more than 10x in the last 10 years.

Valuation:

Market cap: 25B€

Net debt: 1.2B€

Sartorius is trading at a 32x 2024 GAAP EPS according to analyst estimates, which might look expensive, but take a look at how it has compounded in the past. It certainly deserves a high multiple. If analyst have it right, EPS will compound at 17% until 2027. I would probably prefer to buy Sartorius than Danaher or Thermo Fisher, since the price is more or less the same but it is smaller and should grow faster, but I will have to take a deeper look to how recurrent the business is and other factors.

Eurofins Scientific

This is one of my holdings (starting price 64€), I got a full writeup here. For me, it is easier to understand since it’s not a complicated diversified conglomerate and I think they can easily compound earnings for many years at 10-15%. They are also targeting margin expansion and trying to dominate the testing industry. It has fell a lot since they had a lot of covid revenues that they lost so it’s not so cheap.

Valuation:

Market cap: 11.5B

Net Debt: 2.8B

GAAP EPS estimates are 2.39 for 2023 and 2.99 for 2024 (a nice recovery is expected) which would bring it to a forward PE of 25 (2023) and 20 (2024). I think it is a very fair price for a long-term compounder with a great owner-operator.

I would say it has more runway than TMO and DHR, since it’s smaller size allows them to capture more opportunities. It is dominating the testing industry and benefiting from scale economies.

Waters Corporation

Business: High-value analytical technologies

Capital allocation: Buyback cannibal.

Valuation: There’s around 5% CAGR organic growth plus the buybacks. Will not be a huge compounder, entry valuation is very important. EV/EBIT is regressing to the mean. Similar to Agilent and Mettler Toledo but a bit cheaper!

Bonus:

These names is not on the list since they are not considered from the “Life Science Tools and Services”, but it is very interesting so I added it!

SDI Group plc (the little Danaher from the UK?)

Business: Serial acquirer of niche scientific businesses. There’s a great writeup here (make sure to subscribe to Fairway research). The businesses are obviously lower quality than the above mentioned in my opinion, also subject to disruption and with lower organic growth. But they are very diversified.

Capital allocation: Acquisitions. While the businesses that they acquire are lower quality, they are able to acquire them at much lower prices, which has helped them compound earnings at high rates.

Valuation: There has been a lot of covid distortion in the earnings since the company got extraordinary orders for covid-related products that also boosted the margins.

Some things to know:

I think operating margins will go back down to 15%-16% and they will loose some revenue.

However, they have acquired several businesses in 2022-2023 which will boost revenues, total revenue should be up in 2023-2024.

So, in 2022 they acquired a company in early January, so the profits where included during all the year. They also acquired a company in March, with 900k EBIT, so probably around 225k in EBIT are missing from 2022 numbers. In 2023 they acquired two companies with 1.972k EBIT. So the missing EBIT in 2022 from all 2022-2023 acquisitions is 2.197k.

Then we can take the 2022 sales, which were 49.66 million, eliminate the 8 million in covid revenues, which leaves us with 41.66 million in sales. To that we apply a 15% EBIT margin to reach 6.25 million EBIT.

Estimated EBIT for 2024:

· 2.19 million EBIT from the acquisitions

· 6.25 million EBIT from the business ex-covid

· Total = 8.44 million EBIT

The current EV is 176.8 million so this is trading at around forward 21x EV/EBIT. This is a napkin math calculation, should dig deeper, but the point is that it is more expensive than what numbers would suggest.

My assumptions do not include organic growth. My estimates are pretty conservative to be honest, maybe too much. Analysts are expecting 11 million EBIT in 2024, which would leave the valuation at 16x EV/EBIT, a huge difference. Maybe there’s something wrong with my numbers.

P.S: Keep in mind EBIT does not include tax rate which is at over 20%, so this is not so cheap. The thing here is that if they continue executing their acquisitions successfully, they will keep compounding at higher rates that Thermo Fisher, Danaher, Eurofins and other serial acquirers who have gotten very big already.

Conclusions

For the buyback cannibals such as Mettler Toledo, Agilent and Waters there has been a lot of multiple expansion and I don’t think they will bring such great returns in the future. If I pick one it would probably be Waters Corp. Probably returns should be around 5-7% plus 2-4% from buybacks, so around 7-11% growth in EPS.

For the serial acquirers such as Thermo Fisher and Danaher, I expect them to outperform the market in the long-term with solid 10-12% CAGR in EPS, but nothing crazy like it was in the past. I prefer these ones to the buyback cannibals though. Eurofins should be around the same, but I can understand the business better and I like their owner-operator’s strategy.

Sartorius has got me curious though, I will check it more. But it is hard to understand how recurrent their business is. I will look some more at it and maybe make an individual writeup in the future.

For SDI Group, I want to see how the margins and EBIT evolve. If someone has a better insight and thinks my numbers are wrong, please leave me a comment. I need to know how 2024 numbers will be like before deciding anything, I think analysts have their estimates too high.

Thanks for reading.

great entry Oscar! thanks for making better understandable this market. Please, have a look at swedish Biotage and come back to me. thanks

Great post. Currently own Danaher and SDI Group. Looking to adding Sartorius but my current shopping list is quite long :)