Eurofins is a scientific company that has been consolidating the testing industry for decades by acquiring and integrating new laboratories into its network. Eurofins is dedicated to all types of testing (food, environmental, pharmaceutical and cosmetic products,...). I consider it to be a long-lasting, high terminal value business with high barriers to entry. The management is very aligned with the shareholder and as you can see, they have achieved amazing returns over the long term:

Covid represented a huge increase in sales and profit margin in 2020 and 2021. In 2022, investors have started to predict a large decline in covid-related test sales and the stock has corrected more than 40%.

The History of Eurofins and Gilles Martin

Gilles Martin (born 1963) is the founder of Eurofins Scientific. His parents were both chemistry professors at the University of Nantes. During his time at university, Gilles developed a diagnostic system that would later be used by the first Eurofins laboratory. Upon completion of his master's degree and PhD, Gilles Martin founded the first Eurofins Scientific laboratory.

Eurofins started with a small wine analysis laboratory in Nantes (France) in 1987 with only three employees. At first, they only tested wines for alcohol and sugar content, then expanded their testing offerings to testing the purity of various types of foods and beverages. A perfect example of a company that starts in a profitable niche and over time expands to dominate an entire market. For decades, they have been buying and integrating Eurofins laboratories and laboratory groups and have formed one of the largest networks in the testing industry.

Eurofins currently has a network of 940 laboratories, 61,000 employees and a presence in 59 countries. Eurofins has a portfolio of more than 200,000 different types of tests and performs 450 million tests per year.

How have they expanded so much in 35 years? With excellent management and capital allocation. Dr. Martin founded the company in 1987 and is still CEO in 2022. The Martin family owns 32.8% of the outstanding shares worth €4.2 billion and 66% of the voting rights of Eurofins (full control over the company). Gilles' salary is €1,205,400 so his entire net worth depends on the share value, his salary is not significant.

Eurofins has made more than 470 acquisitions since 1987 and has expanded worldwide. The M&A strategy is usually based on buying laboratories or groups of laboratories, integrating them into Eurofins and making them more profitable by increasing profit margin and sales. In addition, Eurofins also opens its own laboratories and grows organically. The strategy remains the same today, only on a larger scale and expanding worldwide.

The testing industry - resilient to crises and growing

The testing industry is resistant to economic downturns and growing faster than GDP (organic growth ~7% per year). In times of crisis, Eurofins services will continue to be in demand as food, water and pharmaceuticals must continue to be tested.

Government regulations in the US and Europe are increasing and have a positive impact on the industry (your customers are forced to do more testing). The rest of the world is also experiencing a huge growth in regulations requiring companies to do all kinds of testing (in Asia in particular, regulation is developing rapidly). Eurofins complies with all international regulations that pose a barrier to entry for new competitors.

Eurofins' sales are visible and recurring, by definition, their customers repeat constantly as they have to constantly test their products (e.g. a food producer will send samples of each batch produced to Eurofins for analysis).

Regarding inflation, they have the power to raise prices, especially in areas where they know they are still the best value proposition:

"once we know that our labs are the most cost-effective in the market, if we see our costs going up, we have to increase our price and our competitors will do the same anyway." Q1 2022 Call - Gilles Martin

"Just on the inflation side, which was a question and is a recurring question, we intend to raise our prices to deal with costs that are going up. We have generally delayed cost increases because we generally raise wages once a year at the beginning of the year. And we also have annual contracts with many of our customers that were reviewed earlier in the year." - Q2 2022 Call - Gilles Martin

Scale Economy: Why does it make sense to consolidate the testing industry?

Testing is an industry that makes a lot of sense to consolidate and that is what Eurofins has been doing for many years. The testing industry is a highly fragmented industry. There are tens of thousands of labs all over the world performing different tests.

For Eurofins' customers it makes the most sense to have one single supplier with a presence in all countries that can perform all the tests that that they need, in compliance with all regulations, quickly and inexpensively. That is why the strategy of buying and integrating laboratories makes so much sense and has worked so well.

In addition, there is another variant: volume. The cost of doing a test 2 times a day is 20% of the cost of doing it 1000 times a day. This means a huge increase in efficiency as the volume increases. Therefore, it will always be cheaper for the customer to have a supplier with a high volume of tests than a small lab that handles a few tests per day.

Eurofins has two types of laboratories. The large laboratories that are dedicated to doing the most common tests and manage large volumes and the small laboratories close to the customer that do less common tests but where the speed of obtaining the result is critical. The labs operate with a decentralized structure managed by leading entrepreneurs. Since 2020 Eurofins is consolidating smaller and inefficient labs with the larger labs to achieve better costs and higher efficiency, they are also investing heavily in IT technology for full digitalization of all operations in their labs (and even connecting their customers to their lab).

International Expansion

Eurofins is expanding worldwide and is no longer just a European company:

The "Rest of the World" segment is mainly composed of China (where they are expanding rapidly and are currently around 100 M€ in sales), India and Latin America. I believe that outside Europe the company still has a lot of room for growth.

Covid-19: From tailwind to headwind.

As you can imagine, Covid-19 greatly benefited Eurofins Scientific by expanding their profit margins and sales. Adding a lot of new tests using the same facilities allowed them to increase their profit margin with economies of scale.

Net income margin went from 4-6% pre-covid to 10-12% post-covid and FCF margin went from 6-9% pre-covid to 15-17% post-covid. As you can see over the last 12 months, as sales volume is reduced by Covid, margins are falling again.

The value of Eurofins shares tripled since the start of Covid-19 from €40 to €120/share and then fell by ~45% to the current value:

Investors paid high multiples for a FCF inflated by Covid. After seeing that those margins were not sustainable and adding the Fed rate hike and macroeconomic problems, many have sold the stock. In any case, consider that the stock is still 55% more expensive than before Covid while sales have increased by 47%.

The key to valuing Eurofins will be to know how much covid-related sales it can sustain in the long term and what the company's future margin will be. Will it return to the margins of the past or will it be able to maintain a somewhat higher margin? On the other hand, I assume that in the long term they will continue to have organic and inorganic growth, as well as continuing their international expansion.

In 2020, they devoted all their efforts to Covid, so it is normal that sales excluding Covid grew by only 1.67%. Covid sales reached 15% of the total.

In 2021, sales excluding Covid grew again by 14%. Covid sales reached 21% of the total.

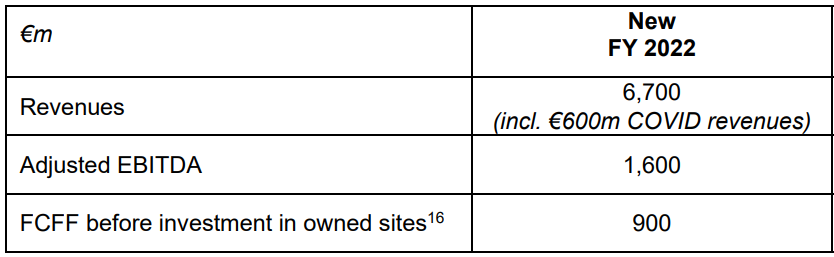

The company's guidance (which they reiterated in Q3) implies that Covid's sales in 2022 will be only €600 million (a 57% drop compared to 2021). On the other hand, no one has any idea what will happen after 2022 as the company has withdrawn its guidance for 2023 and 2024:

"Due to uncertainties arising from the Ukraine war, inflation, interest rates and exchange rate developments, Eurofins is currently only updating its 2022 targets." - Results 1H2022

I guess the withdrawal of guidance adds uncertainty and does not help the stock at all. The company has said that they will give 2023/24 guidance again on February 22, 2023, when they release their annual results.

As I read in the Q2 2022 call, the guidance was withdrawn as they have no idea how much they will have to raise prices in 2023, so sales could go up quite a bit if there is inflation, and they want to defend their margins:

"If the world is facing 10% inflation, obviously, we're going to have to raise prices much higher than we thought we were going to raise them when we set that target. That's why we deferred that decision, or that one, until early 2023, when we will report our 2022 result.

I mean, can you tell me if this year's inflation will be for Europe and North America, which is the bulk of our business, what year will 2022 be? 3%, 5%, 4%, 7%, 8%, I think I don't know, and if I knew, maybe I would answer your question. And on top of that, what would be the inflation expectations for 2023 for Europe and North America? Nobody knows. That's why we think it would be unprofessional. It wouldn't be honest at all to make any kind of forecast for 2023." - Gilles Martin Q2 2022

Before withdrawing the guidance for 2023/24, they had published one in Q1 that included zero covid sales in those years (see below). I think it is too premature to consider that there will be no covid sales in 2023/24, but it is good that this guidance is conservative. What is surprising is that even without covid sales, Adjusted EBITDA and "FCFF before investment in owned sites" remained at levels higher than FY2022 and this suggests to me that the company intends to defend FY2022 earnings and maintain margins higher than pre-covid but lower than Covid.

We will see more about this in the valuation section.

The excess cash generated by covid-19 was used, among other things, to:

Buy land and buildings (which will reduce long-term rental expenses).

Repay some debt and refinance debt at lower rates in 2021

Buy companies with €252 M in sales in FY2021

Investments in IT, digitization and cybersecurity

Capital allocation

Eurofins' business generates FCF every year and changes in working capital are very small. In addition, there is virtually no stock based compensation, so FCF is reliable. This capital is allocated to M&A, a buyback program (which authorizes the repurchase of up to 2% of the company's shares) and debt repayment. Currently all investments are financed from the company's FCF but previously equity and debt were issued to finance them, which is why shares outstanding have increased in recent years.

M&A spend in 2021 was €533M which contributed €252M in sales, so Eurofins is buying companies at ~2x sales. There is no data on company margins (purchases could be around 15-20x earnings). They are certainly not cheap buys, but they are high quality, high recurring businesses. Eurofins, after buying the companies, creates synergies and increases sales and profit margin.

Eurofins not only does M&A but is also opening "start-up" laboratories (yes, they lose money for a few years until they become profitable) in new and emerging markets where they have no presence and there are no M&A opportunities. Since 2000, more than 200 start-up labs have been opened. In 2021, 23 "start-up" laboratories were opened, which subtract profits from the group, but will add profits in the future:

Normalized returns on capital employed are 10-15% (I would not exclude goodwill here) now that the company is in a more mature stage:

My model and valuation

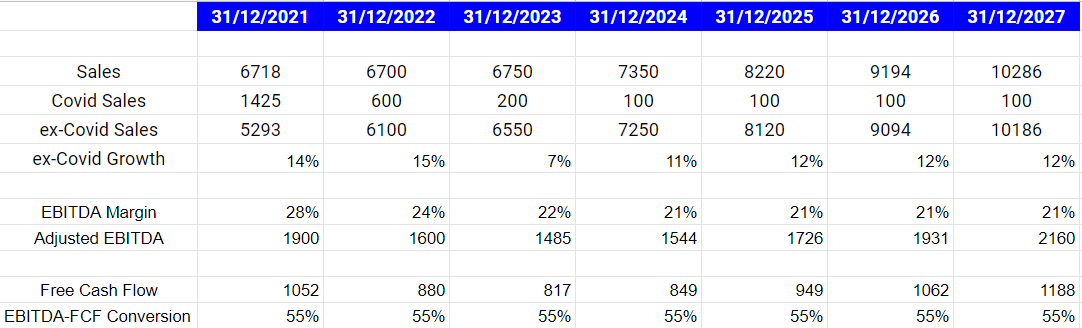

Eurofins has said its target EBITDA margin is 24% and I am assuming that it will compress to 21% as the company's covid sales decline. I have assumed that in 2027 the margin will still be 21%, although it could increase with economies of scale. I have assumed that covid sales will not disappear completely and will remain at €100m/year (although I believe it will be higher).

For 2023 and 2024 I have used the guidance given by the company for sales, but reducing the margin and adding 200 and 100 M€ in covid sales. From 2025 onwards I have simulated a 12% annual sales growth (which is much lower than the 24% CAGR that the company grew from 2012-2019).

I consider that if they only grow at 12%, they will be able to finance that growth with their FCF (7% organic growth + 5% inorganic) so there will be no need to dilute shares or take on debt. On the other hand, if management feels it is better to re-leverage the company, that could mean much higher growth (but perhaps more debt and a small dilution of shares).

Current valuation (2023):

Market Cap: 13.200 M€

Net debt: 2.697 M€ (1-4% interest rates)

Enterprise Value: 15.897 M€

Diluted Shares Outstanding: 192,42 M

The current 2023 EV/FCF (before discretionary investment in owned sites) is 19.5. I consider this to be a fair price for this company, I do not consider it to be undervalued, but it is a company with a high terminal value as I believe it will continue to exist and grow for decades.

With my growth considerations, Eurofins could use FCF as follows:

60% of FCF for acquisitions

20% of FCF for dividend payments

20% of FCF for share buybacks or debt repayments

Seeing the interest rates on their debt, I don't think they are interested in repaying it, so I am going to model that they buy back shares and the debt stays the same. That would mean about €200M in buybacks per year for a 1.5% decrease in outstanding shares per year (although as I say, they will probably dilute in the future to finance acquisitions).

Valuation in 2027 with my calculations (5 years):

Enterprise Value = 1.188 x 24 (FCF multiple) = 28.512 M€

Net Debt = 2.697 M€

Market Cap = 28.512 - 2.697 = 25.815 M€

Diluted Shares = 178.41 million

Stock Price in 2027 = 25.815/178,41 = 144,7 €

At the current price of 68 €, this would imply a return of 16% per annum over 5 years, to which the dividend, currently 1.5% per annum, should be added.

Of course this scenario will probably have virtually nothing to do with reality, as, depending on the M&A opportunities they find, they may grow further and not buy back shares or even issue equity and debt to finance growth. The important thing (in my opinion), is not this valuation, but to understand that this is a family of owner-operators with all the family wealth at stake and a high terminal value business that is building a significant defensive moat.

A more optimistic scenario would imply that the company manages to maintain the target EBITDA margin of 24% and grow above 12% per year. In that case, profitability would be above 20%.

A more pessimistic scenario would imply that EBITDA margins return to pre-covid levels of 18% and then profitability would be lower at ~12% + dividends.

Either way it seems that this valuation offers a good margin of safety over the long term. I consider that I would be paying a reasonable price for an excellent business with strong defensive moats.

Note: It is also interesting that Eurofins is listed in Euros, so if the EUR-USD were to return to levels above 1.15 (as it was a few months ago), it would not affect, whereas for USD listed companies it would mean a negative return.

Competition and comparables

Comparable companies to Eurofins are SGS, Bureau Veritas and Intertek. However, they are not exactly competitors of Eurofins, as explained in the annual report:

"The Eurofins companies do not consider any other company as an exact competitor in all the segments and regions in which they operate (...) Increasingly the Eurofins companies are more and more comparable to the activities of the following companies. In the area of clinical diagnostics and pharmaceuticals, Evotec, Abcam, Albany Molecular Research, PPD (Thermo Fisher), Syneos Health, Quest Diagnostics, Cambrex, Catalent, Covance (LabCorp Group), IQVIA, ICON and Charles River are competitors along with other Contract Research Organizations (CROs) such as PRA Health Sciences and Parexel.

Some outside credit and equity research analysts compare Eurofins to certain publicly traded testing, inspection and certification ("TIC") companies, such as SGS, Intertek, Bureau Veritas and ALS Global. However, these TIC companies are not pure laboratory testing companies and Eurofins has limited overlap with them and only a very small presence in these markets." 2021 Annual Report

There is no company like Eurofins, although it does have competition in all its segments. Although Eurofins is growing faster than all its "competitors", it has a somewhat lower valuation:

Subscribe for more interesting articles! For those of you who are already subscribed, I'd really appreciate it if you could share it on Twitter!

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument, the content is merely educational and only my opinion. Each person has to make his own analysis. My analysis could be totally wrong and the stock could have negative returns. For now I have no position in Eurofins, but it is very likely that I will initiate a position in the near future.

UPDATES:

24 June 2024:

Today Muddy Waters published a short report on Eurofins. It has been well known for years that the company leases real estate from another company owned by the CEO, so there is nothing really new here besides showing some specific bad transactions. Luckily I sold my shares at €60 to add to SDI Group, but now that it’s at €42 I will revisit Eurofins. Have not made a decision yet, but I still think at current prices SDI Group is a much better option, it’s also cheaper on NTM earnings basis while ROIC should be much higher.

Eurofins has been investing in owning their own real estate, while this is great long-term, it is very low return on capital short term. Now that the company has dipped to 13x NTM earnings, I think they should start doing aggressive buybacks, if I do not see them doing that, I will probably not invest since I like my other ideas more, but at current price it should do pretty well going forward, especially if they deliver on their margin expansion targets and buy back shares at these levels.

There surely is some amount of shady stuff going on inside Eurofins, but Im not sure it’s very material, they now have the chance to prove to shareholders that they have their interest in mind by buying back shares aggressively. I feel that Eurofins was a great investment in the past, when it was rolling up the entire sector, but now that it has reached maturity, the return on capital has gone down substantially, so I think a large buyback is a great way to signal to shareholders they have their interests in mind.

It’s a better short report than the one they did on Fairfax though, that one was total trash. They did some investigative work this time.

3 July 2024: Finally decided to buy some after Eurofins said they might increase share buybacks and rebutted Muddy Water’s short report point by point.

Hola Oscar,

Me parece un trabajazo, enhorabuena y gracias! Pero me queda una duda clave. Basas tu valuación a EV/FCF, y has fijado una conversión de EBITDA FCF del 55% que corresponde a 2021, año que creo no es extrapolable a proyección. O tienes algún motivo para fijar ese % de conversión? he visto en TIKR que estiman menores FCF que los tuyos.

Gracias crack!

Hola Óscar,

gracias por la tesis.

¿te has visto el informe bajista de Shadowfall?

https://www.shadowfall.com/wp-content/uploads/2019/01/Eurofins_ShadowFall_Research_Report_FINAL_16_Oct_2011.pdf