Water Intelligence PLC $WATR

A resilient business run by an Owner-Operator with international expansion, M&A opportunities, organic growth, and trading at a fair price.

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument. Please do your own research. My analysis could be totally wrong and the stock could have negative returns. At the current moment I own shares of Water Intelligence PLC.

Water Intelligence PLC is a small cap stock trading in the Alternative Investment Market (AIM, a sub-market of the London Stock Exchange). Even though it trades in London, the vast majority of its revenues are from the United States. Keep in mind this is a highly illiquid small cap with a lot of volatility.

Patrick DeSouza (The Owner-Operator) and the origin of Water Intelligence

Patrick DeSouza is the CEO of Water Intelligence. He owns 37.5% of the shares outstanding (around 60 million USD) through his personal stake and his owned company Plain Sight Systems, Inc. Patrick is very aligned with minority shareholders since his ownership stake is worth more than 90 times his annual compensation (654.385 USD in 2021).

Dr. DeSouza has a Law degree from Yale and an International Relations PhD from Stanford (specialized on movement of capital). He first started practicing law in New York for a Private Equity firm. He later started Plain Sight Systems (a tech incubator at Yale) with the idea of injecting technology on businesses to transform their business model (he combines his tech knowledge with his Private Equity knowledge). Water Intelligence was born with this same idea.

Dr. DeSouza acquired American Leak Detection in 2006 (this is now fully owned by Water Intelligence PLC). At the time American Leak Detection was a franchise business that was spread across the United States and specialized in using technology to detect the source of water leaks. Patrick’s vision was to transform the company into a full-service operation that solved all sorts of problems in water infrastructure. During the journey, he has found out plenty of ways to deploy capital, including franchise repurchases (which we will see later) and organic growth.

The current Water Intelligence

Water Intelligence is a platform company that uses technology (acoustic and infra-red) to detect and fix water leaks in any kind of pipe: small pipes (houses), larger pipes (buildings) and big diameter pipers (municipal water). They also find leaks in sewer and waste water. Once an individual has a leak he directly calls the company or is referred to it by a third party (such as an insurer or a plumbing company).

One of the competitive advantages of Water Intelligence is that they operate across the entire United States (46 states, 150 locations) which is of great importance, since it has helped them win insurance contracts that require full country coverage. Once an insurance customer has a water leak, they call their insurance company and the insurer sends Water Intelligence to do the job. However, most of their revenue is from non-insurance customers who find Water Intelligence (or usually American Leak Detection) through the internet or recommended by their local communities.

Additionally, Water Intelligence is expanding internationally, with 6 locations in Australia, 3 locations in Canada and 1 location in the United Kingdom.

The business is resilient to economic downturns (since it’s services are essential) and it will also be very durable since there is an enormous problem of aging water infrastructure that needs to be replaced. Most water infrastructure was built decades ago and it would be very costly to replace it (just think about all the pipes going through buildings). As an example, my flat in Barcelona was built in the 1970s and the water pipes remain the same, the same happens to most buildings! It’s much easier to repair the leaks than to replace the entire thing. Since World War II many types of pipes have been used: clay, copper, iron and plastic pipes, and they all end up deteriorating, they all have different problems. Additionally, with environmental catastrophes, such as earthquakes, or freezings, or tectonic movement of the ground the pipe joints will move causing new leaks.

Another competitive advantage is that plumbers will usually break the wall until they find the leak while Water Intelligence uses technology to pinpoint the exact location of the leak and fix it with minimal damage (this is highly appreciated by the customers). They acquire customers using digital marketing, but most importantly through their long-term reputation (American Leak Detection was founded in 1974). Once they help a customer with their most urgent problem (the water leak), they gain their trust and might offer other solutions to other problems. They operate with branded vehicles, their employees wear uniforms and they have standard procedures.

Water Intelligence is implementing Salesforce’s software, which should bring a ton of efficiencies, automate business processes to increase workforce productivity and enable a faster rate of growth to help scale the business while keeping operations properly organized. As you can see by now, they are always investing in new technologies.

Capital allocation

When hearing Patrick talk about capital allocation, I have a feeling that he has a ton of ideas to deploy capital with great returns. He has been sourcing capital from Free Cash Flow, debt and share issuances at high multiples. He is also very prudent and mindful of the need to keep a good balance sheet during a possible recession in 2023.

The capital is being allocated with the following priorities:

1-Organic growth:

The most important priority is organic growth. And it is done through several initiatives:

Adding extra trucks and employees on owned locations to capture market share. Each added truck and employee contributes positively to profit margin if they are able to keep them busy since the rest of the location costs are fixed.

Expanding internationally using the proven model of American Leak Detection.

Growing their insurance segment by gaining new contracts with large insurers.

2-Acquisitions:

The second priority, which has also been great for shareholders is acquisitions. And here, there is a bit of a special situation that gives Water Intelligence a huge capital deployment opportunity. American Leak Detection (the U.S business) is actually a franchise business with 150 locations. Currently, there are 81 franchises and 37 locations are directly owned by Water Intelligence (some franchises own multiple locations). When Patrick bought ALD there was a larger number of franchised locations which they are currently reacquiring.

The rationale for reacquiring franchises is that owners of the ALD franchises are small business owners and some of them care more about the profits than capturing market share and do not invest in expanding their business. For this reason, Water Intelligence is making offers to franchise owners to buy their business and many of those offers have been accepted. Once Water Intelligence repurchases a franchise, it invests in it, hires a professional manager and tries to grow its sales and profits.

Franchised Locations pay monthly royalties to Water Intelligence (as a percentage of sales) which are reported in the income statement. Once a franchise is repurchased, the full amount of sales and profits is recognized in the income statement becoming a Corporate Owned Location.

Water Intelligence has been very disciplined with the price paid for acquisitions. As you can see in the table below, the company reports the purchase price and adjusted profit before tax of every acquired company. The average multiple paid for acquisitions during 2020, 2021 and 2022 was 4,8x adjusted profit before tax. Assuming a 25% Tax Rate it would be around 6,5x profit after tax. The price paid includes all the assets of the business (such as real estate, trucks, equipment,…) needed to conduct the operations.

Note: Even though most acquisitions are franchise reacquisitions, some are not (such as a plumbing company in 2022 and a leak detection business in the UK in 2021). This shows that the opportunity to consolidate the sector goes beyond the franchises, and beyond the U.S business.

Water Intelligence expects to keep slowly reacquiring franchises and any other type of company that allows them to gain market share (if they are able to purchase it at a fair price). Having more franchised locations than owned locations, there is still a big opportunity to deploy capital at good rates of return, if owners decide to sell at WI’s purchase prices. Owners of franchises are happy with this since they can keep their business while knowing that whenever they want to retire, they will be able to sell it, it is a win-win situation.

The sales of the full network (corporate locations + franchised locations of ALD) have been growing organically every year. So this are not stagnant businesses, the price of ~6,5x profit after tax is for at least a single digit growing business with durability and pricing power.

Valuation

Before proceeding to value the company you must know two important things on the 2021 and 2022 results.

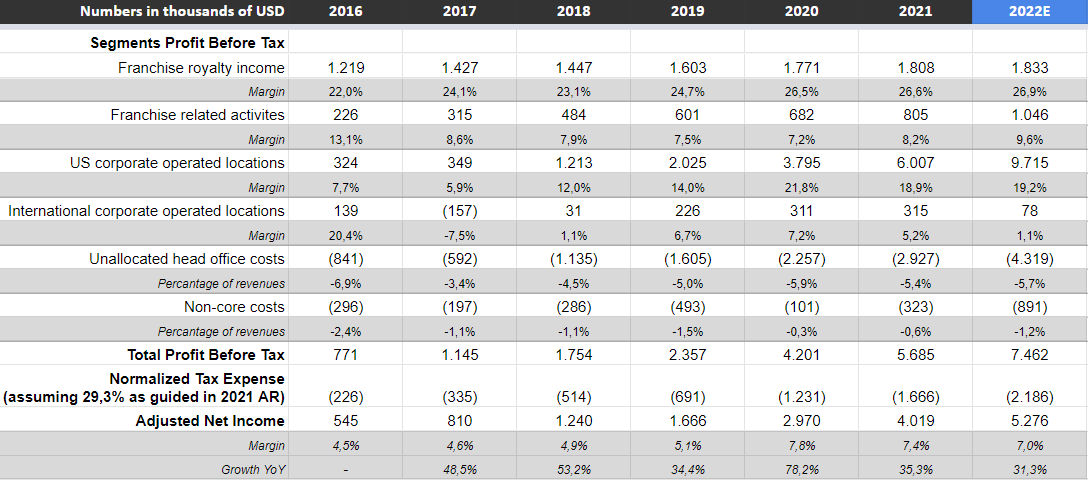

In 2021 Water Intelligence’s profits increased by 1.87 million USD due to a one time gain related to covid subsidies (forgiveness of the PPP loan). This needs to be excluded to normalize the results. Being a small cap company I am sure many people did not exclude this and got surprised once margins fell in 2022.

In 1H 2022 Water Intelligence hired 45 new technicians who have been receiving a salary but have not yet generated revenues or profits since they are currently in training stage (the skills needed to perform the business needs require some months of training). For this reason profit margin has declined. It is expected that once this new employees start performing jobs, sales will grow and profit margin will expand (2023 and beyond). This also means that the 28% same store sales growth on Corporate Operated Locations reported in Q3 2022 does not include any revenues generated by this employees. Being a small cap company I am sure that many people have missed this. For context there were 379 employees as of 2021, so around 12% of employees are currently not generating revenues (but will in the future), I do not know which percentage of technicians they are but it is higher than 12% for sure!.

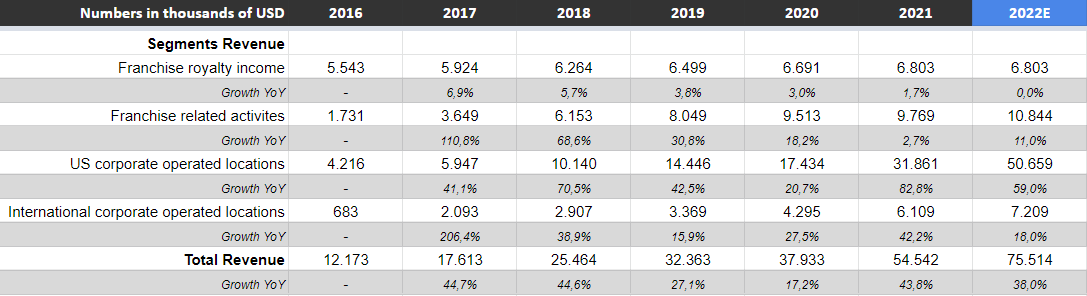

For 2022, which has not been yet reported, I assumed they would grow all the segments at the same rate as what they grew up to the Q3 trading update. Numbers could vary a bit but they should get around 75.5 million USD in revenue for the year.

I also assumed that the margin for all segments would be the same as reported in the 1H 2022 report, but for the full year. Additionally, I normalized the tax rate at 29,3% for all years, to have a fair comparison, since some years had different tax rates. 29,3% was guidance for the future tax rates from the 2021 annual report.

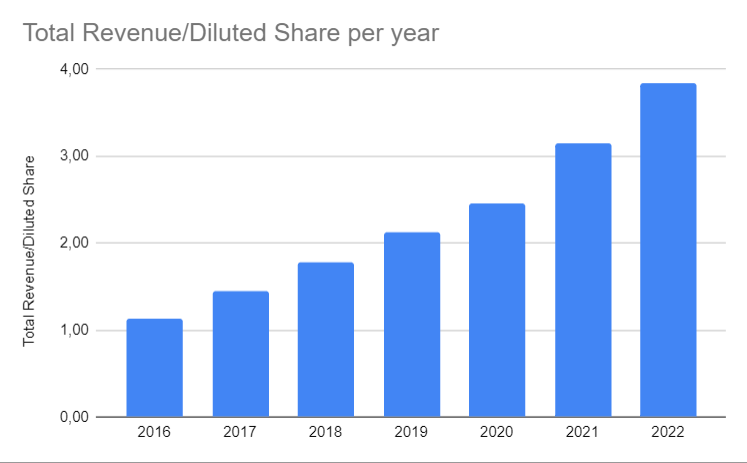

Finally: We need to adjust all this growth numbers by the amount of shares outstanding, which has been growing to finance all the acquisitions (and there is some Stock Based Compensation which we will see later).

On a per share basis, revenue has grown at a 24% CAGR and net income has grown at a 34% CAGR for the past six years. So even adjusting per diluted shares, we get quite a nice growth. The acquisitions have really fueled this per share growth, since issuing shares at high multiples while buying franchises at ~6.5x earnings looks like an awesome deal to me.

Assuming 0,29 USD of net income per share in 2022, which are 0,24 GBP. The current PE Ratio of Water Intelligence is 24.6 at today’s share price of 5,92 GBP.

However, we must remember some things:

45 technicians are not yet providing revenues, just salary and education costs. I assume that once they start working, the profit margin on U.S corporate locations should surge to record highs (>22%). Unless they keep hiring even more people (which would delay this)

International corporate operated locations have a profit margin of just 1,1%, while the U.S locations have a 19% profit margin. I assume the profit margin will go up in this segment as it gains scale in future years

So, keep in mind that while the PE Ratio was not real in 2021 (due to the one off covid subsidies gain, which is excluded in my numbers), the 2023 margins should be higher than 2022. Additionally, this company is executing very well and has a ton of growth to achieve in the future, I find a 24.6 PE Ratio a very nice deal, and I expect it to keep growing profits per share at least at 15% CAGR for some time.

Cash generation does not look bad either, although there is always a big amount of receivables which make the changes in working capital negative. Check the cashflow statement below:

I am not planning on doing any future projections on revenue or earnings, basically, because it is not possible to know at which rate they will keep doing acquisitions and investing in organic growth, so it would be just some imaginary Excel experiment. Personally, I think the current multiple (of probably depressed earnings) is low for the quality and potential of this business and I find that Patrick DeSouza is a very talented and ambitious Owner-Operator, so I leave it in his hands. He also has a lot in stake so that makes me believe he will do his best.

If Patrick can keep compounding per share net income at 20%, which I believe he can for some years, the current multiple is very low compared to the future cash flows of the business. In the short-term we might see a lot of volatility, but I am pretty confident in the future. I hope this post was a good business profile and helped you understand the opportunity here.

Note: I plan on updating the valuation on the bottom of this post once we get the 2022 full year results.

Competition and comparables

Plumbing is a licensed operation which is very local. The market is very fragmented and the only companies who have national scale in the U.S are Roto-Rooter and Water Intelligence. Private Equity firms are also buying plumbing companies.

Roto-Rooter is owned by Chemed Corp which has been a 35 bagger stock. Chemed owns VITAS aswell (which is a healtchare provider that has nothing to do with water infrastructure).

According to Patrick, Roto-Rooter is more specialized in sewer and drain and they often work together with them. If Roto-Rooter cannot find the origin of the leak they will call American Leak Detection to help them find it. The market has a referral mechanism and everyone refers business to plumbers if they don’t have their own plumbers available (or they are busy doing another job). After checking our Roto-Rooter, I do not find it a substantial threat to Water Intelligence. The market is much bigger than this two companies, and very fragmented with lots of players.

Additionally, the market is growing and the TAM is very big. Water Intelligence is just a very small company with 75 million in USD revenue who is trying to capture market share and offer different solutions while the U.S market alone is of over 7.900 million USD.

Catalysts

Water Intelligene published a press release that highlighted the possible benefits of the approval of the Biden infrastructure plan. The Plan has a budget of 110 billion USD for rebuilding water infrastructure such as aging pipes. According to the press release: “The Group is well-positioned across its business units to provide solutions for the water infrastructure problems identified by the Plan”.

If Water Intelligence were to issue shares or lever up the balance sheet to continue with it’s acquisitions it would probably also boost the per share growth rates, since they are able to pay low prices (compared to market multiples).

Extra Resources

Want to dig deeper? Here you have two more write-ups on Water Intelligence:

· Draco Global (Quim Abril) Writeup of $WATR

· Turtle Capital Writeup of $WATR (Translate from Spanish using Chrome)

Also, the best would be to read the 2021 annual report and the most current trading updates.

In the video below you can find the only available Patrick DeSouza interview I could find in the internet (starts in English at min 2:44). I want to thank Quim for helping us meet Patrick. It is great to be able to meet and ask some questions to the CEO of a small cap company. Just watch it, it is worth your time.

My key takeaways on Patrick from the interview:

Old water infrastructure and the impact of climate change are important issues that highly motivate Patrick. He is also very interested in technology.

He sounds very professional and trustworthy. He knows the road-map the company will follow and how it will allocate capital to generate meaningful returns.

Well that is all. Do not forget to subscribe and share this on Twitter!

Updates:

Update (June 2023): Comments on 2022 and Q1 2023 results

Water Intelligence just posted the 2022 audited results, and I thought many of you would appreciate my quick comments since the stock looks pretty much dead right now as it is flat since 2018 (with a lot of valuation compression).

If you have not read the results, you can check them out in the links below. I will just make some quick comments on the most important parts but they are much better explained in the official releases:

2022 results

OK, so first of all, let’s look at top line revenue growth and adjust it on a per share basis, since WATR is a net share issuer.

The company is clearly growing the top line on a per share basis (22.7% CAGR), but what about the bottom line? Let’s take a look:

The bottom line looks much worse, as it has not really grown since 2020. But what is the reason for this? I already explained in my first post that Water Intelligence had hired 45 technicians which were in training and did not produce revenues in 2022, nor were they expected to produce revenues until H2 2023. They are also investing in the Salesforce software and highly increasing Head Office costs (which are not producing revenue either). All this investments are reducing the profit margin, but, in my opinion, are preparing the company for high organic growth and margin expansion in the years ahead (starting 2024).

Patrick DeSouza (CEO) has always said that he plans to invest aggressively to transform the company into a full-service operation that solved all sorts of problems in water infrastructure. I think he clearly acknowledged that, to reach that goal, they will have to get a better software and increase their head office staff, to later train and add new technicians that will increase the revenues of the company. If you believe him, we should see margin expansion starting H2 2023 and 2024.

As you can see in the image below, operating income is growing in all segments (except International locations which is under-performing in 2022 and still at an early stage) but the total growth in operating income has been neutralized by the growth in Head Office and Non-core costs. As I told you, if you trust Patrick, the reason for this is that they have invested to prepare the company for huge growth in the future.

I must say, that if you saw my first post, I expected US corporate locations to make 9.7 million in operating income, which was obviously wrong, since it did not factor the effect of the hired technicians. The final numbers came out at 8.2 million, which is 1.5 million less. Also Unallocated head office costs came up at 4.9 million instead of the 4.3 I expected. All in all, 2 million less of operating income, which is a lot (My bad! Make sure to run your own numbers and not trust anyone). But… I do think this is transitory and we will see huge improvements in 2024, this is a long-term story.

By the way: If you look at Q1 2023 results, profit before tax has grown by 28%, so clearly the company is going in the right direction! 2022 results are past now, we need to think about 2024 results and further for this growth company.

Profit Before Tax (Statutory) grew by 28% to $1.8 million (Q1 2022: $1.4 million) - Q1 2023 trading update

So, I think the profit margin situation is already starting to get fixed, and I don’t know how H2 2023 will look like but in theory it should be much better. So maybe 2023 is a huge year of EPS growth.

Now, regarding the reacquisition of franchises, I think that they have their hands tied up with all this organic growth investments, and we will see less franchise reacquisitions than in the past:

Cash at $19.4 million. Bank Debt and Deferred Acquisition Payments at $29.3 million with payments spread through 2027 at a fixed interest rate of approximately 5% - Q1 2023 trading update

As you can see above, net cash is at negative 10 million, so I do not see much room for acquisitions at all, at least for some time. However, I do see a lot of organic growth going forward. During 2022 US Corporate operated locations had 26% organic revenue growth (13% organic profit before tax growth).

Regarding International locations, the reason for the decline in profits is the following:

Much of the decline in profits is attributable to extraordinary conditions in Australia (147k USD) during Q1 2022 identified below in non-core costs and initial investments in the UK Wat-er-Save Services Limited during 1H 2022 after its acquisition in Q4 2021. - 2022 report

Finance expense is also up since 2021 (-1.57 in 2022 vs. -0.97 million in 2021). This is because debt is up, they loaded up the balance sheet to get a fixed 5% rate before rates were up. But it is an additional cost!

Something many of you noticed is that Weighted Average Diluted Shares Outstanding are up 7.3% compared to 2021. However, they did not issue shares this year and only 95.000 shares were granted in options in 2022, so how is this possible? I think it might be something in the calculation of the weighted average.

Please check this link, there is a 1 minute video with a great explanation.

Diluted Weighted Average of Ordinary shares went up from 17.28 to 18.55 million (+7.3% YoY). However, if we look at Note 21, we see that shares are not up that much at all in a YoY basis, and in the cashflow statement, they did not get financing from new shares. So the only possible reason for this is that the weighted average of 2021 shares was much lower than the shares outstanding in 31 December 2021.

I expect that shares will not grow much in 2023 (unless they issue new shares, which I do not expect at current valuations).

Finally, regarding the cash flow statement:

Operating cash flows before working capital are up 15%, and working capital has been lower than in 2021. This is very positive!

Capex (including purchase of plant and equipment and intangible assets) has been much higher than 2021. The reason for this is that the company has strongly invested in organic growth for the future

And here you can clearly see the biggest addition to intangible assets was Salesforce:

All in all, I think Water Intelligence is going in the right direction and we should see fundamentals improve a lot in 2024 and beyond. Once all this investments are done, they should have more FCF to reacquire franchises again.

Make sure to subscribe for further updates!

Thanks Oscar, I have a question regarding "plumbers will usually break the wall until they find the leak while Water Intelligence uses technology to pinpoint the exact location of the leak and fix it with minimal damage (this is highly appreciated by the customers). " I am not sure if this true all over the world. Because I recently had a clogged drain in Munich, Germany. And the plumber company we found on the housing admin list, did have one those Sewer Cameras that you can buy on Amazon etc. for 100-1000€. It is a big initial investment into capex, but I think brick-and-mortar plumbers are already using this.

Hi Oscar - excellent write up! Any indication if the company will stop using equity to fund new acquisitions and instead use FCF/debt? I understand the acquisitions are per share accretive given the multiples they are buying at but seems would be better for shareholders if they limited the share dilution and even bought back shares.

Also I noticed you can’t buy shares on interactive brokers - what platform did you buy them on?