DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument. Please do your own research. My analysis could be totally wrong and the stock could have negative returns. This information is for general purposes only and should not be considered as investment advice. I am not a financial advisor and do not offer investment recommendations.

DISCLOSURE: I currently own $PAGS shares and call options.

Today I bring you an interesting Event-Driven situation that I found out about after reading the following twit:

This is just a quick post with my thoughts, make sure to Do Your Own Research.

As a reminder, I explained Event-Driven Investing in this video. My strategy will revolve around buying cheap stocks that benefit from a macroeconomic event, with the intention to sell them after they re-rate.

The Event: Brazil Lowers Interest Rates

Brazil's central bank signaled on that a majority of its policymakers see a possibility of a rate cut at its next meeting in August, provided that a more benign inflation scenario consolidates. Inflation has come down to 4% while rates are still 13.75%.

Chile has already cut rates by 1%, being the first country in Latin America. Knowing that Brazil’s central bank has already announced a first rate cut in August, I think that event will certainly happen.

The Brazil 2-Year Bond yield has already fallen to 10.8%, which shows that the market already expects that interest rates will be significantly lower in the future.

How To Profit From This? The PAGS situation

Now that we know that it is highly likely that Brazil will start cutting rates (currently at 13.75%). We need to find out who will be positively impacted by this event.

PagSeguro Digital Ltd. (which has been renamed as PagBank) is a payments fintech company that has been hugely impacted by the raise in interest rates (but also by increased competition that led to lower prices).

Here is a quick business description from the 20-F:

So… How has PAGS been harmed by the raise in interest rates? Well, just take a look at the following text:

PAGS customers (mostly mid and small business owners) that get paid with a credit card will need to wait some time to get the payment (receivable), alternatively, they can get the payment instantly (early payment of receivables) by paying a fee. This fee is recognized as Financial Income in the income statement. In order to fund this receivables, PAGS (and third parties such as an investment fund called FDIC) incur in some Financial Expenses that are highly dependant on interest rates.

As you can see below, financial expenses have gone up 30x while financial income has only gone up 3x since 2020. That is because rates have skyrocketed to 13.75%.

When interest rates go down in Brazil, $PAGS will benefit by a reduction of financial expenses, which are 2x Net Income. Financial income should not be affected as much since it’s in control of PAGS (it’s what they charge businesses to get their receivables) and it has always been growing.

In theory, if interest rates went down by 50%, to ~7%, financial expenses could drop by 50%, and net income could double. Any drop in rates will be great for PAGS.

The rest of the company is also growing aswell. Revenues from transaction activities and other services is mostly comissions and fees on the payments that the businesses receive and it has been growing a lot. Lower rates could also impact consumption and lead to higher revenues from transactions and other services.

So.. what are we paying for this opportunity? $PAGS is trading at 9x NTM PE with huge upside (I think 20x on much higher earnings is possible). I think this could very likely be a multibagger in a short period of time. It used to trade at 20-50x earnings, so 20x seems very likely in my opinion. Lower rates should be the perfect catalyst for a rerating. Doubling the multiple plus doubling the EPS would be a 4x (not saying this will happen).

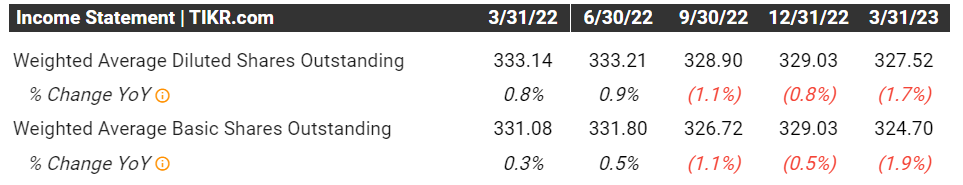

Additionally, they are even doing some buybacks (1.9% of shares per year as of Q1 2023):

Risks

A second wave of inflation or other unknown events could change the central bank’s easing policies

PAGS could have to lower prices to their clients due to increased competition which would partially or totally cancel the benefits of lower interest rates (reducing financial income).

Currency risk

Other risks that I have not thought about

Make sure to share and subscribe.

Updates

August 2, 2023 - First Rate Cut to 13.25%

August 6, 2023 - Made some quick calculations on the effect of interest rates

November 2, 2023 - Adding to my position at lower prices

November 17, 2023 - Q3-2023 shows financial expenses going down and profits up

February 28, 2024 - Q4-2023 looking good

February 29, 2024 - Reducing a bit my position

March 1, 2024 - Sold most of the position

We are on the same page with $PAGS. I think they are doing a better job than $STNE so far.

Great article Óscar! Thank you very much!