Interest Rates: How To Profit From This?

What worked in the way up and what will work in the way down

I am starting a new series of blog posts focused on Event-Driven Investing. It will be called “How To Profit From This?” and it will feature my thoughts on a certain event.

As a reminder, I explained Event-Driven Investing in this video. My strategy will revolve around buying cheap stocks that benefit from a macroeconomic event, with the intention to sell them after they re-rate.

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument. Please do your own research. My analysis could be totally wrong and the stock could have negative returns. This information is for general purposes only and should not be considered as investment advice. I am not a financial advisor and do not offer investment recommendations.

DISCLOSURE: I currently own shares of Fairfax Financial and Georgia Capital

Who Benefited from the Raise of Interest Rates

The Federal Funds Effective Rate just hit 4.83%, coming up from 0.08% in February of 2022. The Federal Reserve had to raise rates rapidly to fight the inflation they created by overstimulating the economy in 2020-2021 as a response to the pandemic.

One of the most crowded and obvious trades was to short long duration government bonds that were emitted with a low coupon. It really was a great trade although it required leverage or the use of options to make a big profit. At the time I was not into Event-Driven Investing so I did not participate.

Additionally, there were two industries that were supposed to benefit from the raise of interest rates:

Insurance: Insurance companies invest heavily in fixed-income securities, such as bonds, and an increase in interest rates can boost the returns on these investments, leading to higher profits for insurers.

Banking: Banks generally benefit from higher interest rates, as they can charge borrowers more for loans, while still paying depositors a relatively low interest rate. This can lead to higher profits for banks.

Out of all insurance companies, I chose Fairfax Financial for my Event-Driven investment because it had a low price to book ratio and a huge short-term duration bond portfolio that they could renew at higher rates. Although I was a bit late and missed most of the rally, I still hold this position and I think it should be worth around 50% more. It still trades at around 1x book value and even with 3% rates it will produce a lot of investment income.

I did not invest in any particular bank, although I want to highlight the incredible performance of Bank of Georgia (I don’t own shares directly but Georgia Capital does and I own the stock). Interest rates went to double digit in Georgia and the bank just started printing money.

Quick Note: The fact that an Event is supposed to improve the fundamentals of a sector does not mean that the sector will perform properly as a whole, you need to find the specific companies that are best positioned for this event, and they need to be cheap. The performance of the sector as a whole has been surprisingly bad due to the banking crisis.

Interest Rate Forecast

OK, so what will happen with rates in the future?

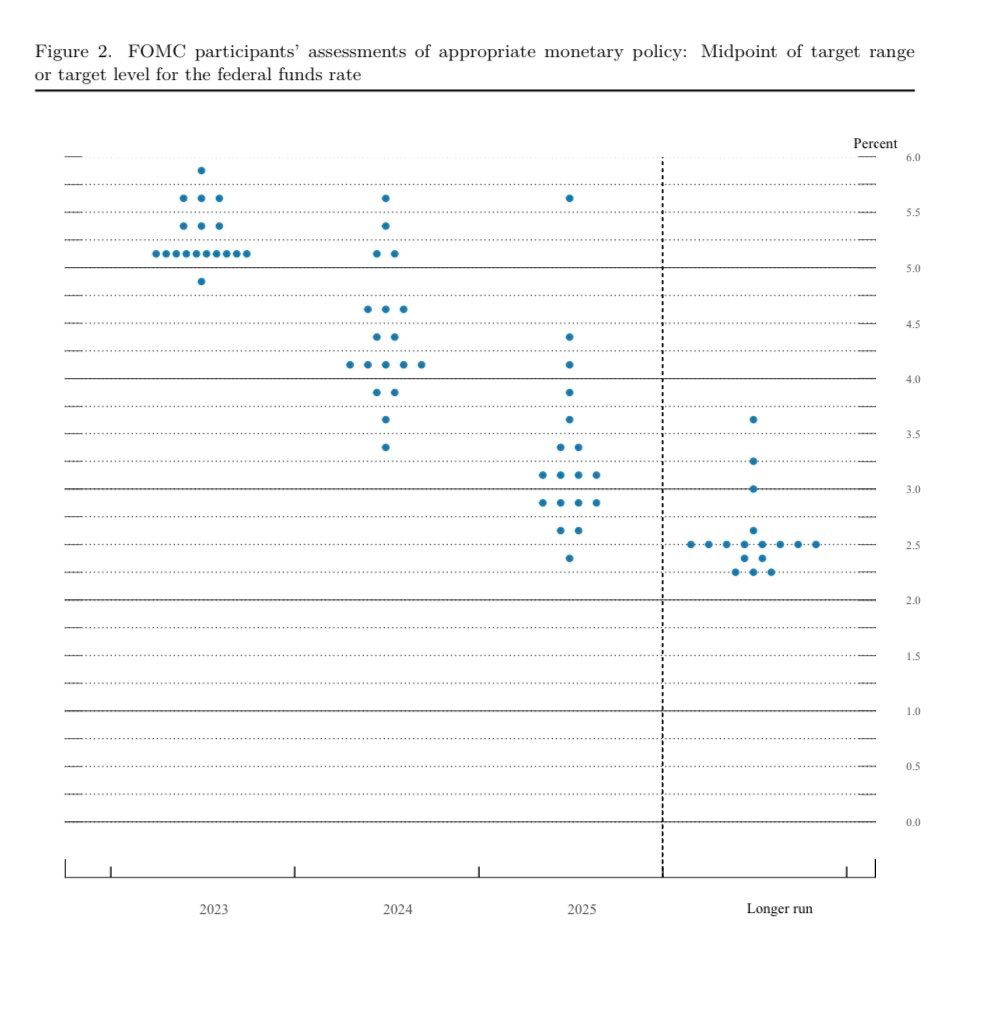

According to Fed projections, rates will be:

Around 5% in 2023

Around 4% in 2024

Around 3% in 2025

Around 2.5% long-term

With this projections I am happy to stay invested in Fairfax Financial. Their bonds will keep getting renewed at nice rates. However, we must keep in mind that the Fed has a long history of bad projections.

What if the Fed is forced to lower rates much faster?

As you know, usually the Fed reacts to bad economic data by stimulating the economy. If for some reason, the Fed ends up being forced to lower rates (which I do not really think it will), there will surely be new opportunities.

Here are some opportunities I have thought about, in case this happens:

Long Duration Government Bonds: This is the obvious one. They went down when rates went up and they should go up a lot if rates are lowered aggressively. My pick here would be to buy call options on TLT.

Real Estate: Real Estate related stocks are getting hammered right now. One of the stocks I have an eye on is Vonovia, which owns apartments in Europe (mostly Germany). It’s trading at 0.47x Price to Book (although they are devaluing the portfolio). It has 101B€ in assets and 67B€ in liabilities and a market cap of 15B€ so it’s price is implying a pretty large drop in property prices of around 20%, which I do not think will happen. If rates are lowered aggressively, I think Vonovia will rerate pretty fast. Vonovia is in Europe, but the ECB usually follows whatever the Fed does with some delay.

Another option for Real Estate could simply be VNQ or some other ETF

Automobiles: Lower interest rates can make it easier and more affordable for consumers to take out loans to purchase cars, leading to increased demand for new and used vehicles. I am not so sure about this one though, I really dislike the car industry as an investment, it’s very low margin and competitive. Additionally, if the FED is forced to raise rates, it will probably be because of a bad economic situation, so this companies could struggle anyways. However, here you have a list of some car companies from my TIKR screener ordered by forward PE Ratio:

Final notes

I do not think that we will see a sudden drop in rates, so this won’t probably be actionable. But in the case that we do see it, I will be ready to act fast with this research.

If you think some other company or sector could benefit from this, or know about any actionable event that is happening right now, please make sure to write a comment below. Also subscribe and share this post!

Very interesting this new series "How To Profit From This?" 😉