Georgia Capital PLC

Trading at a 60% discount to NAV while paying down debt and buying back shares... What about risks?

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument. Please do your own research. My analysis could be totally wrong and the stock could have negative returns. This information is for general purposes only and should not be considered as investment advice. I am not a financial advisor and do not offer investment recommendations.

DISCLOSURE: At the current moment I own shares of Georgia Capital PLC.

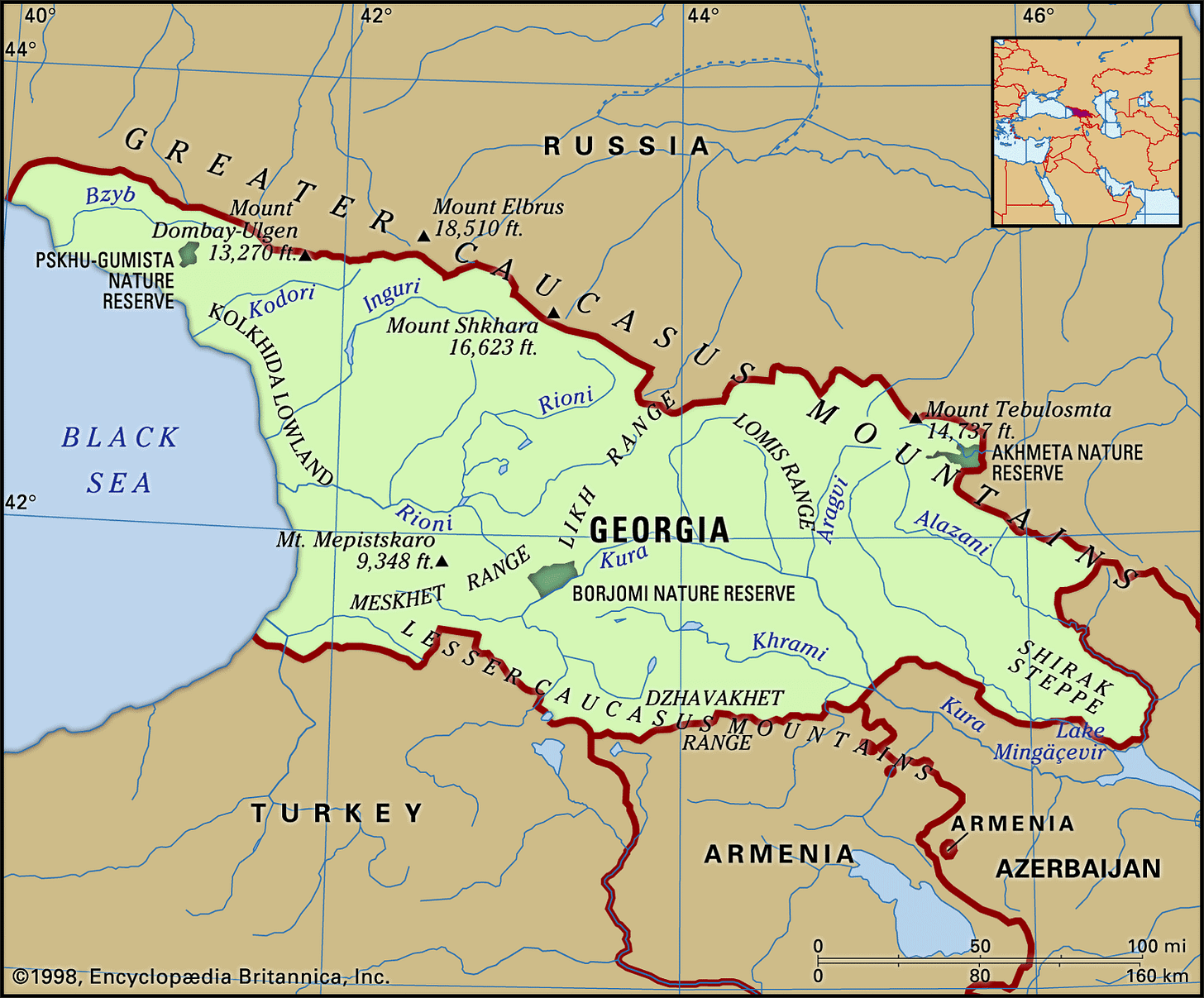

Georgia Capital PLC is a small cap stock trading in London. Keep in mind this is a highly illiquid small cap with a lot of volatility. Additionally, Georgia’s geographical location makes it susceptible to various geopolitical and currency risks which we will further analyze.

I found out of Georgia Capital PLC after checking the positions in the fund of one of my favorite Spanish fund managers: Edgar Fernández Vidal (who manages Tercio Capital). The Spanish financial community is great and I hope to bring your more of their ideas. Edgar only invests in deeply undervalued companies so you can imagine this one might be one of those.

As a reminder: None of my investment ideas are “original” and I do not use screeners, I try to follow great people and extract the best of them. Obviously, I do not copy anything, I do my own research, but I like to have a large network of good investors to learn from.

Irakli Gilauri (The Owner-Operator) and the origin of Georgia Capital

Georgia Capital PLC (LON: CGEO) is a private equity firm that was spun off from Bank of Georgia (LON: BGEO), which is the second bigest bank of Georgia if we measure it by it’s assets.

Irakli Gilauri was the CEO of the Bank of Georgia (1.3B GBP market cap). Once the spinoff of Georgia Capital was announced, he switched roles to work as the CEO of Georgia Capital. It is interesting that he went from a bigger company to a smaller one (335 M GBP market cap). He probably thought he would have more fun and be able to be more creative at the smaller one. Irakli Gilauri owns 5.2% of Georgia Capital (21M USD). Mr. Gilauri has no cash salary but he does take his full compensation in stock options that vest over a multi year period (200,000 shares maximum per year and depending on both share and fundamental performance of the business). I would say he is very aligned with shareholders.

After the collapse of the Soviet Union (1991), Irakli started his Business studies at the Georgia Technical University (1993). At the time Georgia’s capitalist system was at its infancy and the country was very poor, there was not much knowledge on how to conduct business. Irakli decided to learn English during summer as part of a student program (outside of Georgia). Once he found out how much he could learn outside of Georgia he decided he had to leave the country for some years and learned a lot about banking before going back.

As a CEO of Bank of Georgia (from 2004 to 2018) Irakli collaborated with the construction of the country’s banking system and grew the bank’s Total Assets from 200 million GEL to 14.800 million GEL (2018) creating enormous shareholder value.

At his late years in Bank of Georgia, he found out that as the Government divested the assets of the Healthcare system, it had become a huge, fragmented industry that offered a great opportunity for consolidation and started buying assets. They also entered the Pharmacy business, Water Utility business and Insurance. The Healthcare business was separately listed (Georgia Healthcare Group) and Bank of Georgia became a conglomerate with many businesses. They were always opportunistic with the prices paid for businesses allowing them to operate with a huge margin of safety (they tried to pay around half of publicly traded company multiples). They bought most of the Hospitals at around 5-6x EV/EBITDA.

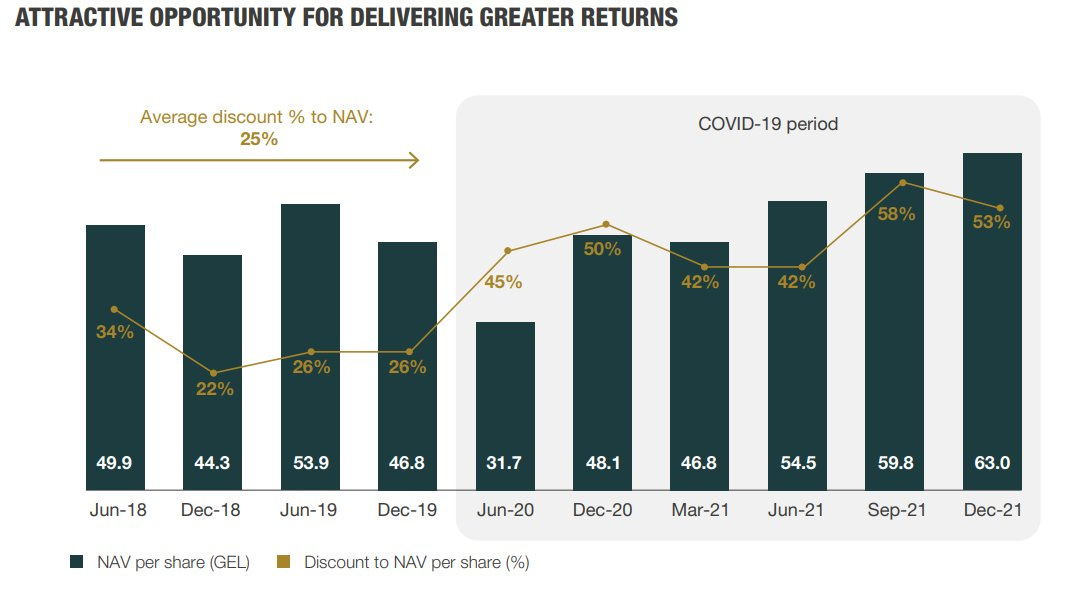

In 2018 they decided to spin-off all non-bank assets and Georgia Capital was born. The structure was getting too complex for the bank’s investors and they thought it was the best idea to separate it (although Georgia Capital owns shares of Bank of Georgia, which I will explain later). There are just 25 employees at Georgia Capital (Holding Company) and their job is to properly allocate capital to create shareholder value. Irakli thinks he can compound NAV per share of Georgia Capital at a 25% CAGR in the future.

Cool story bro, but what is this share dilution!?

I guess many of you checked the financials and found out that shares outstanding have been growing like crazy since the IPO, and may have probably concluded that this is a bad company not worth your time (that was my first thought as well). I mean, why would you issue shares when trading under NAV (Net Asset Value)?

Georgia Healthcare Group (GHG) was only partially owned by Georgia Capital before 2019 (57% ownership). In 2019 they exchanged 3.4 million shares for an additional 13,6% of GHG and in 2020 they acquired the remaining 29.4% of GHG in exchange for 7.7 million shares. So this was not stock that was granted to insiders at a huge discount to NAV (Georgia Capital traded at around 25% discount to NAV at the time).

GHG was a publicly traded company at the time. Shares were struggling after covid (CGEO also struggled), but NAV per share recovered at the end of 2020 (as you can see in the picture above) so it was an accretive acquisition.

Right now, Georgia Capital is taking advantage of the huge discount to NAV to retire shares at a fast pace as seen in the picture below (shares down -4.8% YoY as of September 2022!). So clearly, if you are looking at the past your are not getting a good picture on this.

Are there high management fees?

Holding companies or conglomerates usually trade at a discount to NAV. In my experience, this is usually fair, since managers of this companies charge big fees (such as Bill Ackman charging 1.25% of AUM and 16% of gains to Pershing Square shareholders). Some conglomerates such as Berkshire Hathaway trade at a premium to NAV since they are well-run and charge zero fees.

In the case of Georgia Capital the fees are not low but they should go down with time as assets grow. Current NAV is 2.840 million GEL and total operating expenses for FY2022 are 40 million GEL representing 1.41% of NAV. Georgia Capital plans to reduce operating expenses down to 0.75% of NAV. There are no performance fees (although executive salaries do have performance incentives which are aligned with shareholders).

Operating and interest expenses at the Holding Company level are more than covered by dividend and interest income leaving a positive cash flow that can be used for buybacks and debt reduction. Dividends received are increasing and the payout ratio of the companies is low.

Owned businesses

Now that I clarified the reason why shares outstanding have increased since the IPO and I have also explained the buybacks and management fees I will explain all the owned businesses within Georgia Capital before going to the valuation. However, I will just do a very brief explanation, if you want to learn more about them check the investor day presentations!

Bank of Georgia (LON:BGEO)

Georgia Capital owns 20.6% of the shares of BGEO (publicly traded). For NAV calculations the company uses the current price of BGEO, however, Irakli thinks that BGEO is grossly undervalued since it is trading at just a 2.9 LTM Price to Earnings ratio and 0.95x Price to Book Value.

The rise in interest rates has hugely benefited Bank of Georgia and it should allow them to keep compounding book value at an even greater pace than in the past.

I am pretty confident that BGEO will keep compounding its value. Additionally, BGEO has repurchased 3.6% of it’s stock in the last year and has a 4.5% dividend yield.

Georgia Capital plans to keep trimming it’s stake in BGEO down to 19.9%, so, when BGEO does buybacks, CGEO trims it’s position and gets a cash inflow while maintaining the same ownership percentage:

Water Utility (sold!)

Georgia Capital plans to invest, grow and then finally exit and monetize it’s investments (so no holding forever). In 2014 they acquired 25% of the Water Utility business, in 2016 they acquired the remaining 75%. Total investment cost was GEL 214 million representing a 4.3x EV/EBITDA multiple. In 2021 they exited the business by selling it to an international investor (Aqualia) at 8.9x EV/EBITDA and during the time the business was held it paid out 97.1 M GEL in dividends representing an IRR of 27% in GEL (20% in USD). The sale price represented a 30% premium of what they valued the business at for NAV calculations in the balance sheet.

Georgia Capital still retains 20% of the business through options, but it will finally end up being fully sold.

Retail (Pharmacy)

The Pharmacy Business consists of a growing network of over 359 pharmacies (6 in Armenia), one optics store and 7 cosmetics stores (2 in Armenia). The business is 77% owned (however the stake will increase to 100%, it is already agreed with the sellers). The names of the pharmacy chains are GPC and Pharmadepot.

This business is valued externally at 9.1x EV/EBITDA multiple and it is growing pretty nicely:

Hospitals

EVEX Hospitals is the largest hospital chain in Georgia with 16 hospitals and over 2.500 beds covering 3/4 of Georgia’s population.

This business is valued externally at 12.2x EV/EBITDA multiple and it is growing pretty nicely:

Insurance

Georgia Capital owns a Property and Casualty Insurance and a Medical insurance business. This business is valued externally at 10.7x P/E multiple and it is growing pretty nicely:

Investment Stage Portfolio Companies and Others

Georgia Capital also owns some other companies that are at an investment stage which include Renewable Energy, Education and Clinics and Diagnostics.

Additionally, they own some other smaller businesses such as Auto Service, Beverages, Housing Development and Hospitality.

I do not want to bore you to death with this writeup, so please take a look by yourself if you are interested (check the investor day presentations). Now let’s go with the final part.

Deleveraging

Besides share buybacks, Georgia Capital is also deleveraging the Holding Company by paying down debt (which increases NAV and decreases interest payments). The sale of the Water Utility business brought a lot of cash that was used to pay down debt as seen below:

As you can see in the Balance Sheet above, Georgia Capital is deleveraging and paying down the debt, which is great for NAV (reducing total liabilities) and also to reduce interest payments.

Valuation

Georgia Capital offers a NAV calculator (please take a look) on it’s website where you can see how each business is valued and even edit the values by yourself if you think businesses should be valued differently. Growing businesses are valued at higher multiples than Large Portfolio Companies. All valuations are done externally and through comparison with a Peer Group which can be seen below:

The sale of the Water Utility business at a 30% premium to the external valuation tells me that the valuations are not aggressive at all. Additionally, BGEO trades at a huge discount to fair value. I am not making any adjustments. Georgia Capital is trading at a 61% discount to NAV (or even more).

The management team has a lot of tools to increase NAV per share, such as buybacks, deleveraging, exiting companies,… I find Georgia Capital is grossly undervalued and I trust the CEO who has a lot of skin in the game.

A 61% discount to NAV provides a lot of margin of safety. Additionally, I am very confident they can grow NAV/share at over 15%. I think the market is pretty wrong on this one, but now let’s go check the risks:

Georgia and the geographical risk

Georgia is a very small country, with a population of only 3.7 million. Surprisingly, Georgia has a very pro-business, investor-friendly Government. Socialist parties have less than 5% of the votes and the country has eradicated most of the soviet-era corruption.

The biggest risk for investors is actually not coming from within the country, but from it’s neighbors. Georgia shares the northern border with Russia. In 2008, Georgia was attacked by Russia (yeah most people don’t even know about this) for one month due to a territory dispute. Russian forces occupied Georgian cities for some days. The conflict stopped once Russia got the territories that they claimed. This conflict has been settled for over a decade, and Russia has not manifested any intention to attack again, but of course, Russia is the biggest risk of this investment and there is a reason it currently trades at a discount to NAV after the Russian attack on Ukraine.

The outstanding Russian war with Ukraine has actually benefited Georgia economically. Many Russian migrants have arrived to the country and many companies have left Russia to go to Georgia. Georgia’s exports and GDP are both going up. Tourists visits have recovered with higher spending than in 2019. The IT industry has had a boom. This strange situation has caused the Georgian Lari to appreciate a lot since 2021.

I do not think Russia poses a great risk for Georgia, since they already have the territories that they wanted and are already involved in a war, however, I would not invest a big part of my portfolio in Georgia.

Want to read about Georgia’s relationships with other neighbors? Check this links:

The currency risk

Georgia’s currency is the Georgian Lari (GEL). As you can see in the charts below, the GEL is one of the only currencies that has appreciated against the USD since 2021. If we look at GEL-GBP the appreciation is even stronger since the GBP has lost value against the USD.

Georgia Capital’s NAV is measured in GEL and then converted to GBP. If the GEL were to strongly depreciate, it would reduce the value of the investment in other currencies. I do not have any opinion on where the GEL will go but I think there is a lot of margin of safety with the current valuation and discount to NAV.

Georgia’s current interest rate is high at 11% (the highest it has been since before the great financial crisis). The tight monetary policy supports the currency appreciation.

Extra Resources

Want to dig deeper?

Here you have an interview of the CEO (Irakli Gilauri):

Here you have one more write-up I found on Georgia Capital:

Well that is all. Do not forget to subscribe and share this on Twitter!

Great Write up, but why you use EBITDA and not an other Buisness ratio?

Hello Oscar, I just wanted to let you know that I read your article with Interest. I have referenced it in my own article which is here. https://theoakbloke.substack.com/p/introducing-cgeo-capital-georgia?sd=pf - I would be interested in your feedback, also because I note you appear to have since sold CGEO. Do you regret that sell?