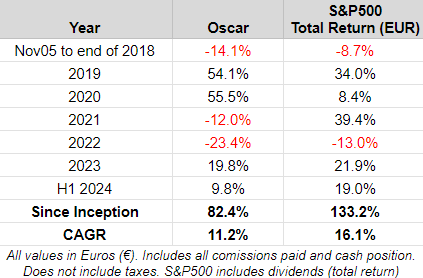

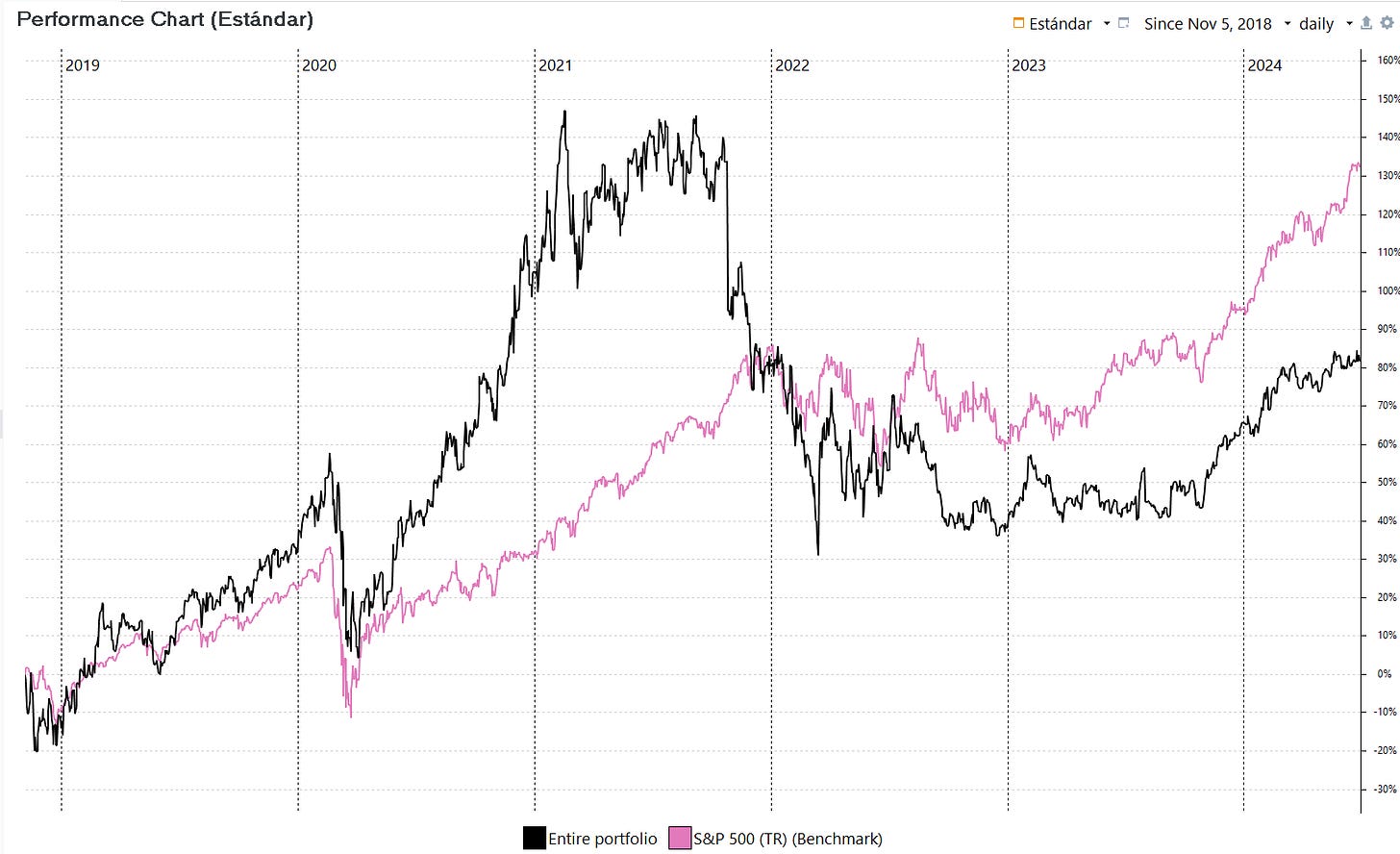

I’m starting this short blog section where I will update my returns twice a year and talk about some of my thoughts and positions. Not sharing my percentage allocation to each position since I need the mental flexibility to make big changes if needed and I think posting it in social media gives me anchoring biases. For all you know, this could all be made up, never trust anyone with their returns unless it’s a fully audited fund or something. Do not trust screenshots either, since they can be easily edited. I could show you a screenshot of one of my IBKR accounts that is up a lot YoY, but that is just one of my accounts, not my full portfolio. My full portfolio returns are the following (up to you to trust them):

I’ve been hugely under-performing sine 2021 as you can see. That is mostly because of the mistakes that I profiled in a couple of articles in the Learnings section of this blog. I think learning from mistakes is the most important thing an investor can do to improve.

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument. Please do your own research. My analysis could be totally wrong and the stocks could have negative returns. This information is for general purposes only and should not be considered as investment advice. I am not a financial advisor and do not offer investment recommendations.

DISCLOSURE: I own positions in the companies highlighted in this article.

Thoughts on Big Tech

Many value investors will tell you that Big Tech is tremendously overvalued. I do not think so. Many of us missed most of the rally because we did not recognize, back in 2022, that some of the best companies in the world were a strong buy at fair prices. Now that they are re-rating to deserved 25-35x high quality multiples and driving the market higher, people are saying it’s a bubble (LOL).

The only one I still hold with a big position is Meta, but I must say that a big mistake was selling Alphabet after ChatGPT was launched (at some point in 2022 I remember it was 10% of the portfolio, ouch). Alphabet had been a core position since the 2020 covid-scare, so what a fail.

Meta Platforms still has the possibility to cut the Reality Labs spending of -16B per year, or improve the margins of the segment. Tailwinds remain for Family of Apps, especially the monetization of WhatsApp. I even made a video back in February 2023 highlighting how good of an opportunity Alphabet and Meta were.

I never even talked about Microsoft, probably one of the best companies in the world that is now having a new earnings stream with AI subscriptions. I even had bearish thoughts on Amazon (what a fail) since I thought their retail segment’s margins would be damaged due to inflation (which happened for some time but then quickly recovered).

All in all, I did not buy enough Big Tech back in 2022, it was a mistake of omission since I follow and like most of the companies. Bought some small/mid caps instead that are at much lower multiples, but also lower quality, I think they have a ton of upside though.

Only question regarding big tech for me is if all that AI capex will pay out. I think it is possible it will. Microsoft will have “AI subscriptions” from ChatGPT, Copilot,… and Meta and Alphabet will have increased Ad performance. AI has been a transformative technology that is much better than value investors admit and it’s still in its infancy. I’ve been testing the premium ChatGPT and it’s great, especially the part were you can create your own GPTs. Not going to chase big tech now though, I’ll stay only with Meta Platforms.

Some position highlights

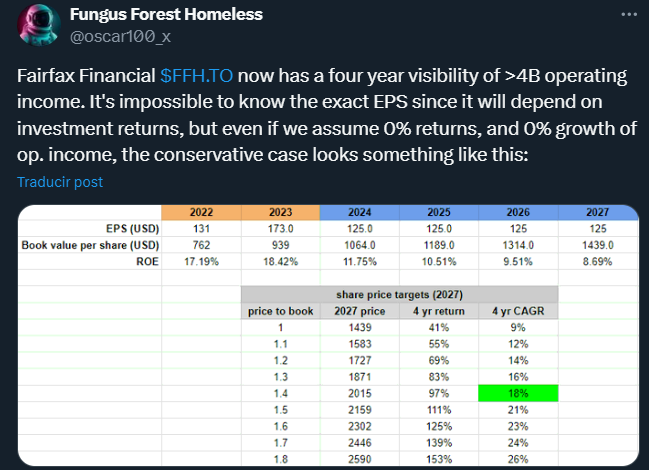

Fairfax Financial remains very undervalued IMO despite the run up. Right now some tailwinds remain that if were to be reversed, could cause some damage. 1. Higher rates than in the past, 2. Hard market in insurance, 3. Good portfolio performance. Valuation is very undemanding. IGIC remains undervalued aswell and their insurance business is higher quality with lower combined ratios, but has less float and portfolio leverage.

UK listed compounders SDI Group and Water Intelligence remain undervalued aswell (especially SDI but there are some management doubts). SDI needs to show investors that they can keep doing accretive acquisitions and the new CEO needs to prove himself on organic growth. Water Intelligence needs to show investors they can increase margins and keep doing franchise repurchases.

Moberg Pharma is very promising but with some risks, check out my writeup.

Evolution AB is a very high quality company with a sin stock discount, they should be more consistent on buybacks and remove that dividend tbh.

British American Tobacco remains undervalued and is seeing some inflections with improved capital allocation (although still really bad, they should go bazooka on buybacks and selling ITC stake). Non-consumables are stating to become more profitable and illegal competition might start being persecuted in the USA.

Bought some Toya SA. Polish small cap, largest shareholder (owns 37% of shares) proposed to create a 100m PLN buyback, which would be 18% of shares outstanding. Low valuation. Seems enough for a re-rating.

PAX Global technology posted a profit warning after giving 5-15% growth guidance (what a bad management team, LOL)